COVID-19 made a huge impact on the New Zealand economy and many businesses are forced to shut down or reduce their capacity during the lockdown. The New Zealand government launched COVID-19 Wage subsidy back in March to support employers and keep more kiwis on the payroll. The original subsidy came to an end on 9th June and replaced by COVID-19 Wage Subsidy extension with tougher criteria. I recognize it would be hard to compare the revenue if you are a sole trader or small or medium-size business with irregular income pattern while the business starting to pick up. You may not be eligible by comparing month-end revenue but you may be eligible by comparing 30-day revenue day by day. So I’ve made a spreadsheet to help the employers and sole traders to check if they may be eligible for the COVID-19 Wage Subsidy extension.

Disclaimer, I am not a qualified accountant. Please consult with a qualified accountant if you are unsure if you are eligible.

COVID-19 Wage Subsidy Extension

A Wage Subsidy Extension payment will be available to support employers, including sole traders, who are still significantly impacted by COVID-19 after the Wage Subsidy ends.

The subsidy extension will be paid at a flat rate of 585.80 for full time (20+ hrs) workers and 350 for a part-time worker (under 20 hrs). The subsidy is paid as a lump sum and covers 8 weeks per employee.

The employer who received the subsidy, need to pass the subsidy to employees, retain the employees for the duration (8 weeks) of the subsidy and do their best to pay employees at least 80% of their normal pay.

What the criteria

In order to get the wage subsidy extension, you must be

- An eligible employer (including contractor and sole traders)

- The business must be in New Zealand

- The employee must be legally working in New Zealand

- You can only apply for subsidy extension after your previous subsidy finished

The most important criteria in the subsidy extension is you must have a revenue loss of at least 40% for a continuous 30 day period. This period needs to be in the 40 days before you apply (but no earlier than 10 May 2020) and must be compared to the closest period last year.

Full criteria list on Work and income

40% loss in 30 days

For any business who is using any accounting software, it will be very easy to generate a report to compare your month-end revenue with the same month last year. However, if your business has an irregular income (like lots of sole trader and Small businesses), your month to month comparison may show you don’t have a 40% drop but your daily comparison slows otherwise.

Here is an example of a small imaginary business with irregular income between June and July in 2019 and 2020.

It had lots of days with no income, some days with under $1000, and some days with $6000+ income.

Here is the month to month income.

There is a drop in July but not a 40% drop. By the looks of it, this business is not eligible for wage subsidy.

However, if we calculate the 30-day total revenue not just at month-end but for every day from 30/6 to 31/7, we will have more data point to compare. On 30/6, the 30-day revenue will be between 1/6 – 30/6. On 1/7, the 30-day revenue will be from 2/6 – 1/7, on 2/7 it will be 3/6 – 2/7… and so on.

I charted the result in the graph below. There is a small window on 2nd and 3rd July that 2020 revenue is lower than 2019 data.

If we focus on the data point at 2/7, it shows between 3/6 to 2/7 in 2020, the 30 days revenue dips below 40% compared to the same period in 2019. It would have been missed if you only compare month-end data.

What this Google sheets for

This google sheet is designed for New Zealand sole trader or Small and medium-sized business owners to check if they fit some of the criteria. It will check when is the earliest they can apply, and it will calculate and compare any continuous 30 daily revenue of this year to the same period in 2019 and check if you have a 40% drop on a day by day basis.

Here is the link for the google sheets

How does it work

Once you click the link, it will ask you to make a copy of the google sheet to your own google drive so all those data stays with you and you alone.

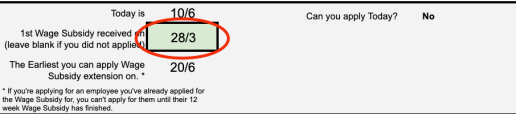

Now you’ve got the google sheet opens up, you can start by putting in the date you received your first wage subsidy at C5. It will calculate the earliest you can apply for wage subsidy extension. Leave it blank if you did not apply.

Once you put in the date, it will check if you can apply the subsidy today.

Next, you will need to fill in your daily revenue in between 10/5/2019 to 31/8/2019 in B19 t0 B132. It will use that data to calculate the 30-days total revenue on column C, apply a 40% drop on 30-days revenue on column D.

After you completed your 2019 revenue figures, you can start filling in revenue from 10/5/2020 on F19 and onward.

If you fill in those daily revenues, it will calculate the total revenue for the prior 30-days and compare that with the same period last year in Column H. You first set of 30-day revenue will appear at C48 and G48.

Example

Here is an example on the google sheet of an imaginary coffee shop owner. She applied for 1st wage subsidy and received on 10/4.

She is trying to apply for the wage subsidy extension as she had a tough month in May. Although her 30-day revenue suffers a 75% drop at the beginning of June, She was not eligible for subsidy in June because the previous 12 weeks Wage Subsidy hasn’t finished. The earliest she can apply will be on 3/7.

Her revenue in May was about 75% drop, but things start to turn around in June and business started to pick up after lockdown lifted. On 3/7, her revenue was about 30% drop compare to the same time last year which is less than a 40% drop. So the in Column H, it shows she is NOT eligible for subsidy extension on that day.

However, according to the wording on Work and income, she needs to show a revenue loss of at least 40% for a continuous 30 day period and that period needs to be in the 40 days before she applies. 40 days before 3/7 was 25/5, and the 30-day revenue that started with 25/5 was on 23/6. So in our example, she can use the revenue reported any day between 23/6 to 3/7 to apply.

So the sales data on 29/6/20, which contain revenue from 31/5 to 29/6, was within the 40 days period and it was lower than the same day in 2019. So it matches the criteria revenue loss of at least 40% for a continuous 30 day period.

Hope this google sheet can help you work out your eligibility and keep more Kiwis on the job. Once again, this tool is for reference only. If you are unsure about your eligibility, please check with your accountant.

You decide how much you want to invest and how frequently. You can invest on a weekly, monthly, quarterly or six-monthly basis. Also, you can choose when the plan start and end. Below is an example for $100 invested monthly with no end date.

You decide how much you want to invest and how frequently. You can invest on a weekly, monthly, quarterly or six-monthly basis. Also, you can choose when the plan start and end. Below is an example for $100 invested monthly with no end date.