Investnow is a new online investment platform and fund management service just started this year in New Zealand. It is NOT an investment firm but a marketplace for investment funds. Kiwi investor can directly invest into the selected fund on investnow platform without the middle man. I’ve done some research on the company and invested some money via the service. Here are my findings.

Range of Fund

Investnow offers 33 different investment funds from both local and international fund manager. The investor needs to deposit minimum $1000 $250 into Investnow transaction account and invest into the fund on their platform at $250 minimum.

Here is the list of the fund provider

No Transaction/Admin/Joining/Setup/Exit Fee

The main selling point for Investnow is no transaction/admin/Joining/Setup/Exit fee at all. When you put $1000 $250 into Investnow, Investnow won’t charge anything on your money. You can invest that full $1000 $250 into different funds. You only need to pay the cost of each investment fund.

Investnow made their profit by charging investment fund providers to list their funds on their platform.

The REAL selling point

Since investor can contact most of those investment funds directly and set up an account, no transaction/admin fee is not a real selling point here. For me, the real selling point for Investnow is low barriers to entry and Vanguard fund.

If you want to invest into those funds directly without Investnow, the majority of those funds have a minimum initial investment amount from $2000 to $500000. For example, Fisher Fund’s International Growth fund require minimum $2000 initial investment and Mint asset management’s Australia New Zealand Real Estate Investment Trust minimum investment is $5000. If you invest from investnow platform, you can put only $250 into those funds. It dramatically lowers the entry requirement for those funds and makes it more accessible to the average retail investor.

Vanguard fund

The most significant benefit with investnow (for me at least) is you got access to Vanguard International Shares Select Exclusions Index Fund. That fund launched for AUS and NZ market in late 2016. It contains about 1500 listed companies across 20 developed international markets (without Australia). This fund is an ethical fund as they excluded Tobacco, controversial weapons and nuclear weapons investment.

Simplicity Kiwisaver invests heavily into this Vanguard fund. 61% of Simplicity Growth fund invested in Vanguard International Shares Select Exclusions Index Fund.

There are two versions of this fund. Vanguard International Shares Select Exclusions Index Fund has a low managed fee at 0.20%. The Fund is exposed to the fluctuating values of foreign currencies, as there will not be any hedging of foreign currencies to the Australian dollar. So this fund has a higher risk due to foreign exchange fluctuation. Vanguard International Shares Select Exclusions Index Fund – NZD Hedged are hedged in New Zealand Dollar with a higher management fee at 0.26% but with lower risk.

For individual investors, if you want to invest into this fund directly, you will have to start with $500,000 AUD. Investnow lower that entry barrier down to just $250. In my opinion, this is a great fund to invest because of the low-cost, diversified portfolio and low barriers to entry.

Everything sounds good, so what’s the catch?

Yes, there one thing not so good about Investnow. You’d need to do your tax return if you invested in Vanguard funds.

Admittedly, I am not good at tax. So the following information may be wrong.

From what I understand, those two Vanguard funds are not the same with other listed fund on their platform as they are not PIEs fund. Vanguard funds are Australian Unit Trusts. Accordingly, they are taxed under the FIF rules (that apply to global shares). Investors need to do their own tax return. Investnow produces consolidated tax information to help investors to complete their own FIF tax return.

My Experience

After some research and background check on the company, I invested $1000 into Investnow and tested it out.

The sign-up process was quite simple; I managed to complete in 5 mins. The interface is easy to understand. The funding and investing took 1-2 days to complete. You can check out your holding and performance any time.

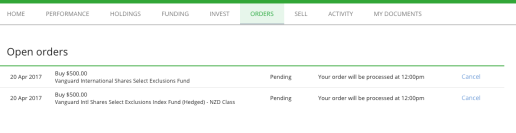

Check out the screenshots below.

One thing worth mentioning is Investnow use a Two-Factor Authentication for login. You need your username, password and a six-digit passcode that send to your email or phone to log in. I recommend using your phone to received that passcode in txt.

Conclusion

So far I am happy with the Investnow as its allow me to access Vanguard fund with just $1000 $250 investment AND no one charging me extra fees in the middle. The service is straightforward and easy to use. The only concern will be the tax implications on its investor if you invest in the Vanguard fund. (Personally, I need to figure that out before next April.)

InvestNow is free to join. You don’t have to deposit $250 to become a user. You can just sign up with an email address and check out the offering.

Investnow is a new company; some investor will (and they should) question the legitimacy of the company/service and the safety of their investment. I’ve done research on that and I will share that in the next post.

(UPDATE: InvestNow recently lower their minimum deposit amount to just $250.)

Email thesmartandlazy@gmail.com or follow me on Twitter @thesmartandlazy if you have any questions.

It’s just a shame there isn’t a convenient way of using automatic payments!

LikeLike

Thanks for doing the research. Great article.

So does the investor own the units in the funds directly? If investnow goes belly up, will there be any risk to our investment?

Also, can we divest our funds through their platform?

LikeLike

Got a confirmation from InvestNow that the investor is the actual holder of the unit in managed fund. If InvestNow goes belly up, we still own those units.

InvestNow fund and separated from Investor fund. The investor fund and held in a trust, ran by trustee and audit by the accounting firm (PWC)

You can divest your fund through their platform. I havn’t done it yet but it suppose to be same as investing. You sell your unit from the managed fund, your money goes into the transaction account. You can invest them on other fund or instruct InvestNow to transfer the money to your bank account.

LikeLike

Pingback: Start your Simplicity investment Fund with just $250 via InvestNow | The Smart and Lazy

Pingback: Simplicity cease offering on InvestNow… but don’t let that stop you | The Smart and Lazy

Pingback: Simplicity cease offering on InvestNow… but don’t let it stop you – Kiwis pursuing Financial Independence and Retiring Early

Pingback: SmartShares, SuperLife, Simplicity & InvestNow. ETF & Index Fund Investing in New Zealand | The Smart and Lazy

Don’t forget you have shareess to start investing in some etc now in finding them really good

LikeLike

That’s great that you are enjoying Sharesies. I’ve got a blog post coming up about them.

LikeLike

Pingback: InvestNow Added SmartShares ETFs into their Offerings | The Smart and Lazy

Pingback: Fund Update: Regular Investing with InvestNow, Cheaper SmartShares and More Funds in Sharesies | The Smart and Lazy