I am a father of two pre-school kids and I been researching on how to invest for them in New Zealand. There are some options out there, but the good one is surprisingly hard to find. So here is my finding on the best way to invest for your children and what you need to know.

There is a lot to write about investing for kids, so I am breaking this topic into three parts. I will talk about why invest for your children and what you need to know before investing here. Part 2 will be my pick on the best investment options for kids and part 3 will be my view on some other investment options in New Zealand.

Why Invest for Your Children

Education: The main reason I invest for my kids is that I want them to know about personal finance. I personally know a few smart and bright teenagers who are horrible with money, which leads them to big money problems (I used to work in student accommodation and know lots of students who left home and flatting with others). It seems like we don’t teach personal finance at school and we don’t talk much about money at home. When some of those kids leave home, they have no idea how to handle money and make a mess with their finances. So for my kids, they will learn about personal finance from a young age. I won’t start them off the complex financial product, but eventually we will get there. That will be a great example to show how their own money is working for them.

We will start with a piggy bank first, but we will get to managed fund… eventually

Prepare for their future: I can’t predict whats going to happen in the future, so I want to do my best to prepare for it. For now, you can get an interest-free student loan for study, but it is not always the case. Student loan used to carry interest and before that, Univesity used to be free. For my kids, I have no idea what sort of society they will be facing, so it’s always better to have something prepared. No matter if they want to go to Univesity, go overseas, start their own business, there will be some money for them.

Best time to invest: There is a Chinese proverb said something like, ““The best time to plant a tree was 20 years ago. The second best time is now.”. For us, we can’t go back 20 years ago and invest for yourself unless we get our hands on a DeLorean DMC-12. At least we can do it for our kids. “It’s not timing the market, it’s time in the market.” By investing at their young age, that investment will have all the time in the world to grow and ride out of recession. It almost guarantees those diversified investments will have a great return once your kids reach adulthood.

You can’t go back 20 years ago to start investing, but you can do it for your kids.

There are two New Zealand personal finance bloggers wrote on this topic I think you should check them out. Ruth from the happy saver wrote a great blog post on ‘Teach kids about money’. Ryan from Money for Young Kiwis wrote another great piece on “Should you invest for your children”.

What do you need?

Before we go into the details, here is a checklist of what you need to set up an investment for your kids.

- IRD number for the kids

- Set up a new email account for kids’ investing purpose

- Identification document for kids (Birth cert, Passport)

- Identification document for guardian (Passport, Driver license)

- Prove of relationship between guardian and child (Birth Cert)

Tax Matter

Some people think children do not pay tax as they have little or no income and that is not true. No matter how cute your kids are, IRD is going to charge tax on them. There is two type tax your kids will be paying, Resident withholding tax (RWT) and Prescribed investor rate (PIR).

Resident withholding tax (RWT) will be familiar to most people because you can see that on your bank statement when you received interest. Resident withholding tax is a tax deducted from a New Zealand tax resident customer’s interest income before they receive it. So it’s basically a tax on your interest and dividend received. Your kids will be using this tax rate if they earn interest from bank deposit or receive a dividend from shares.

Prescribed Investor Rate (PIR) is the rate at which an investor pays tax on their share of taxable investment income from a Portfolio Investment Entity (PIE) investment. It basically taxes on your investment funds like KiwiSaver, index fund and managed fund.

All investment service require IRD number so you MUST register your kid with IRD. If your children don’t have an IRD number, go to this website and get an IRD number for your child. You can check out IRD website to find out the correct RWT and PIR for your kids.

Tax Rate Difference between Adults and Kids

For most kiwi kids who have no income, their RWT and PIR will be at 10.5%. This tax rate is important because average working adult RWT is at 30% or 33% and PIR at 28%. So kids pay much lower tax compared to an adult, and this is a great advantage for kids.

Some parents already set aside some money to invest for their kids under their name because of convenience. There is nothing wrong with that, but it’s not tax efficient. Let’s look at an example below:

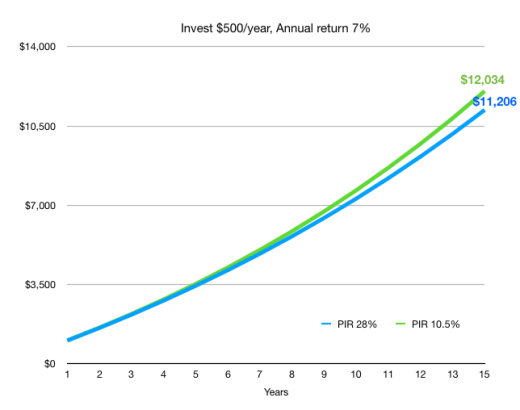

Parent A and B both put $500/years into an investment fund with an average return at 7% after fees before tax. Parent A invested under their own name with PIR at 28%. Parent B invested under their child name with PIR at 10.5%. Here is the result after 15 years.

Parent B’s fund ended up with a higher balance because it was taxed at 10.5%. The actual tax paid with PIR 28% was 1.4% of the fund and 0.525% with PIR at 10.5%. The different is just 0.875%/year. When the kids paid less on tax, more money kept in the fund to grow. At year 15, it resulted in 7.39% different in value.

Remeber, your kids are NOT your tax shelter. Don’t put your own investment and life-saving under your kid’s name to pay less tax. IRD may treat that as tax evasion, and this is a criminal offense. When you invest for your kids, that money supposed to be their money or planning to use for them.

Skip the Bank Account

A popular thing parents do for their kids is to set up a bank account and put money into it for saving and earn a bit of interest. When I look at bank saving, it’s a safe option but not a good investment. Yes, you do earn interest from the bank, but the returns aren’t very good. Also, inflation and tax will reduce your return. You may get some interest on that money but it may worth less in the real terms after inflation.

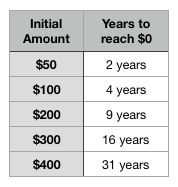

Take a look at the interest rate on high interest saving account from January 2003 to August 2017 below.

Before 2008, you can get about 4% – 8% interest on your deposit and now is above 2%. Let’s add tax and inflation to those interest rate. I will be using RWT at 10.5% as tax rate here.

The green will be the real return on bank interest. It was around 2%-4% before 2008, dropped below 0% at 2010 and currently sitting just above 0%. Therefore, if you keep your kids money in the bank as ‘investment,’ the return is only a better than inflation.

For me, I will still open a bank account for my kids, but the purpose will only be temporary saving. The bank account is not an investment for my kids, it’s just a safe keeping. Most for their money will be sitting in some funds.

Long-Term Investment

Some parents may think investment funds are too volatile for their own risk appetite, that’s why they choose saving account. This is true as saving account provide a low but safe return, investment funds’ return can range from 20% to -20% in a single year. However, we need to separate parent’s risk appetite with kids.

Kids have a lot more time ahead of them compared to their parents. For an average Kiwi kids in an average income family, here is a list of some life events that they may need to use that investment fund.

- Pay for tertiary study at 18-20 years old

- Moving out for job or school around their 20s

- Overseas experience around their 20s

- Buying their first home between 20-35

Most of those events happen around their 20. If you kids are under 10 years old, the investment time frame will be at least 10+ years for them. The common wisdom is you should take more risk when you have a long investment time frame. You shouldn’t worry too much about market downturn as they will definitely occur within their investment timeframe. By staying in the market for a long-term, you will ride out of the recession.

Investment Requirement for Kids

As we’ve established, Kids have different tax treatment, long investment time frame, and higher risk appetite compares to adult. Furthermore, Kids investment fund usually started with a small amount without regular contribution. Therefore, the investment requirement will be different as well. Here is a list

- Age requirement: Must accept under 18 investor

- Investment Time Frame: Mid to long-term

- Risk: Medium to High

- Asset mix: Mostly growth asset

- Tax treatment: Prefer multi-rate PIE fund or RWT

- Management fee: As low as possible (of course!)

- Annual admin fee: As low as possible for good reason

- Initial investment amount: As low as possible

- Lump sum investment amount: As low as possible

- Regular contribution: Prefer not to have regular contribution commitment

The reason we prefer not to have regular contribution is that kids don’t have a regular income. They may only get money once or twice a year for their birthday or Christmas gift. So we prefer an investment without regular contribution commitment, low initial investment and low lump sum investment amount. Parents and relatives can put in some money, no matter a little or a lot, whenever they want.

Watch Out for Annual Fees

Regarding fees, the amount of annual admin fee can be more important than management cost because that fund usually started with a small amount. When you investment fund valued at $20,000, that $30 admin fee is just 0.15% of your holding. However, if your fund valued at $500, that $30 admin fee will be 6% of your holding. Way more than the usual management cost you will be charged. So we prefer an investment with low annual admin fee.

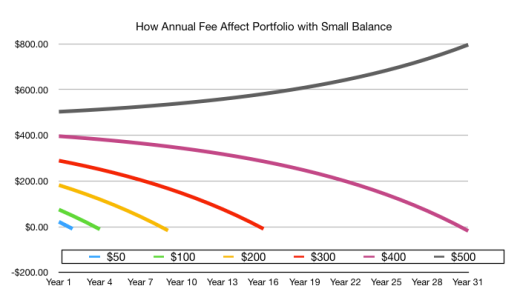

Also, be aware if you started with a small amount and forgot about it for a couple years, the annual fees may eat up your entity portfolio. Check out the graph below on a small portfolio with $30 annual fees, 7% return after tax and management fee and with no further contribution.

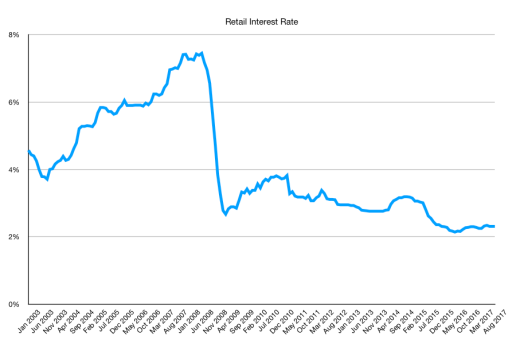

For those portfolio balance with $200 or less, the annual fees will reduce your investment down to zero within 10 years. You won’t be able to keep your initial investment unless you start with $500 or more(based on $30/year annual fee and 7% return).

Therefore, if you plan to put some money in the let it sit for couple years without any contribution, you should start with $500 or more. If you plan to put some more money in at least once a year, you can start at around $250. Anything less than $200 should be kept in the bank. Also, pick an investment service with low or no annual fee will help.

What’s Next?

This is part one of my investing for kids blog. Next part will be my personal pick of the best investment options for kids and how to join them. Part three will be my take on other investment options in New Zealand. If you are currently in or considering some investment program for your kids and want me to cover them, drop me an email at thesmartandlazy@gmail.com. I will try my best to cover that.

Email thesmartandlazy@gmail.com or follow me on Twitter @thesmartandlazy if you have any questions.

Hey Alpha, great post and great topic. I myself have a son who is 1 year old and another baby on the way and have some saving set up for my son and also looking at new investment possibilities for the new baby, so a very timely topic!

Last year when I was looking at investing for my son, I stumbled upon a fund called “MyFuture Fund” at Superlife, but I can’t seem to find anything about it on the website anymore. I never ended up investing in it, but thought I would use it once the second baby comes, but I can’t find it anymore. Do you have any ideas what happened to this fund? or if they’ve replaced it with anything?

Looking forward to your part 2.

LikeLike

SuperLife kind of buried MyFutureFund and took out that section on their web site. Anyway, I am going to feature MyFutureFund in my 2nd part of the blog post and show you how to join MyFutureFund.

LikeLike

So there is a way to still join MyFutureFund?

LikeLiked by 1 person

Yes, SuperLife didn’t explain it well.

LikeLike

Great post. Saving for kids come up often on some groups I belong to and this answers the questions really well. We invested a small lump sum for each of our kids when they were born. The oldest is 6 and we have started to show him when he gets dividends.

LikeLike

Thanks, please feel free to share it around.

LikeLike

Also, I am happy to answer questions if you point me to it.

LikeLike

Finally, my favorite topic. Cant wait for part 2. Keep up the good work, Alpha.

LikeLike

Thanks! Part 2 is coming soon!

LikeLike

Great article Alpha. I’ve had a few people suggest to me signing the kids up to KiwiSaver but to me that makes absolutely no sense. An accessible fund like SuperLife is a much better solution. As far as I can tell, KiwiSaver for anyone under 18 offers no benefits whatsoever.

LikeLiked by 1 person

It was a great option before the government took away the $1000 kick start and MTC. Now the limitation outweighs the little benefit.

The only good thing about kids joining kiwisaver is they’ve got a lot more choices.

LikeLike

That’s true. And it’s probably still a decent savings vehicle for a 15 year old who has just started a part-time job. A good way to get into the habit of saving at least.

LikeLike

Pingback: The Best Way to Invest for Your Children in New Zealand – What to Invest | The Smart and Lazy

Pingback: The Best Way to Invest for Your Children in New Zealand – Other Options | The Smart and Lazy

Pingback: The Best Way to Invest for Your Children in New Zealand Part 1 – What You Need to Know – Kiwis pursuing Financial Independence and Retiring Early

Pingback: The Best Way to Invest for Your Children in New Zealand Part 2- What to Invest – Kiwis pursuing Financial Independence and Retiring Early