This is the part 3 of my investing for kids series. We’ve talked about what you need to prepare and what is my fund recommendation. Now in part 3, we will look at some other investment options for kids.

Term Deposit with Bank

One of the most popular investment options of kids is savings and term deposit in Bank. It is simple, easy to understand, easy to set up and very safe investment. However, since most of the kid’s investment a for the long term, I think bank deposit is just too safe for that time frame. I believe kids can take up more risk than a term deposit. The average return on term deposit was around 4-5% and now is around 3-4%. The long-term return of stock market is about 6-7%.

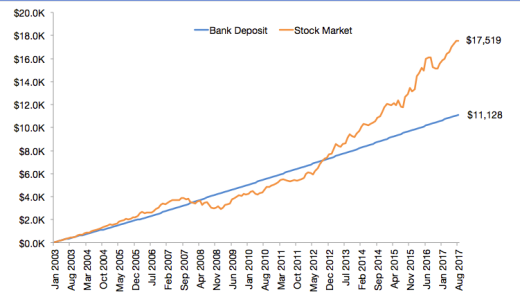

Here is an analysis comparing the return on term deposit and stock investment for 14 years (March 2003 to Aug 2017). I used historical retail term deposit return from RBNZ and compare to NZX50 index return. I ignored dividend in NZX50 for the ease of calculation. In reality, NZX return will be higher if we included dividend reinvest. Monthly contribution is $50. Tax rate at 10.5%.

As you can see, the after-tax return on stock and much better than term deposit in a long run. The share took a dip during GFC in 08-09, and the performance is actually lower than the term deposit. However, it quickly recovers and suppresses bank deposit. In the end, stock overperformed by 57%.

Investment Fund with Bank

Here is a quote from a reader.

“Thanks for the recommendation on your blog. However, I’m concerned the safety of those investment companies. How do I know if they will take my money a run away? Is there any investment with a reliable provider, like a bank?”

Well, a lot of people concerned about those investment service providers is running a Ponzi scam. I’ve done some research on that area, and I am personally are satisfy with the result before I recommend them. We will look into how safe is your investment in another blog post.

Most of the retail bank in New Zealand offers investment product for kids. However, the fees they are charging are much higher compared to my recommendations. Most of the management fee is average at around 1%-2%. They also have a higher initial investment requirement, higher lump sum investment amount. They will charge a to put money into their investment and charge another fee when you want to take your money out. Some of them have performance fee as well. All of those are just too high for my preference.

However, if I have to pick one, I will recommend ASB investment fund. ASB Investment funds management fee is at the low end amongst retail banks. They mostly invested in low-cost passive index fund from BlackRock, and that’s why they can offer a lower fee. Please make sure you understand their fees structure before you join.

Invest in Adult’s Name

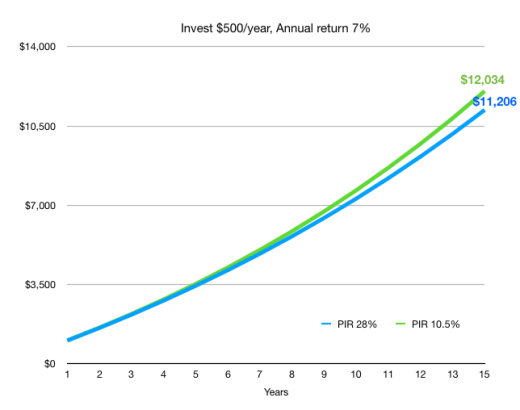

Invest in Adults name is a simple and easy solution. The good thing is you will not be limited by the age restriction from many investment services, and you are free to invest in anything. However, as I pointed out early, the investment return will be taxed at your own PIR rate, so that is not tax efficient.

Here is an example of the same investment with the different tax rate.

SmartShares

When you sign up for SmartShares contribution plan, there is an option for you to sign your kids up for some SmartShares. However, SmartShares is a listed-PIE fund, and all investors got taxed at 28% regardless your PIR rate. So SmartShares will be tax ineffective for your kids.

However, if you already using an accountant, you can get them to claim those tax back.

Ruth from thehappysaver.com wrote two excellent blog posts on putting her kid on SmartShares. Check it out.

SmartShare for Kids part 1 and part 2

Buy Share on Share market

Another common way to invest for children. The Mum/Dad buy shares in some company under their kid’s name. It is great especially if you are already familiar with stock trading. You can also buy SmartShares ETF directly on the stock market which makes it a great options.

However, there is a cost everything you buy or sell on the stock market, so that is not good for regular or small amount investing. Also, you are supposed to pay tax on your dividend received. So there is some added work to do.

KiwiSaver

KiwiSaver used to be top investment choice for your children as they used to be $1000 kick-start and member tax credit for kids. However, our government had taken those benefit away, and the only benefit for kids join KiwiSaver is they will have lots of choices to participate with no limitation. For example, if you want your kids to join the investment fund from Simplicity but they won’t accept under 18 years old, you can get your kids to join their KiwiSaver.

However, the significant disadvantage of KiwiSaver for kids is the limitation on how and when they can use that money. Currently, They can only get the money out to buy their first home, or they turn 65. So it limited how your kids can use that money. They can’t use that for study, can’t use that for OE or start their own business.

If you already started KiwiSaver for your kids, you should keep your money there and let it grow. You don’t have to put more money in until they turn 18 years old.

If you haven’t started, invest your money outside KiwiSaver. Only get them to join once they turn 18.

Bonus Bond

Another favorite gift for kids. Bonus Bonds were first introduced by the Government in 1970 as a way of encouraging New Zealanders to save more. However, people need to understand this.

Bonus Bond is NOT an investment. Bonus bond is merely a placeholder for a lottery.

Bonus Bond pays no interest or dividend. It is highly unlikely your kids will get that million dollar price from them. So if you have the money, you will be better off to keep it in the bank where you can earn interest.

If your kids got them as a gift, you should accept it and understand your kids have a placeholder for a lottery. If your kids have over $100 in bonus bond, you should cash out down to $100 and try your luck.

Conclusion

- A term deposit is a safe investment, but the return is too low.

- Investment product with big banks are subjective safer for some people but comes with a higher cost and more limitation.

- Invest in Adult’s Name is simple and straightforward. Also, it will have a lot more options available. However, you will pay more tax then you suppose to.

- Buy shares on share market is not ideal for regular or small sum investing due to the cost of trade on each transaction.

- KiwiSaver will have more investment options for kids. However, it limits how they can use that money.

- Bouns Bond is NOT an investment. It’s merely a placeholder for a lottery. Don’t put more than $100 in there.

The tax savings over time make a lot of sense, however I am just a bit hesitant to hand over a large sum of money to my future 18 year old, currently 17 months old. Do you think the risk of an 18 year old blowing that lump sum is worth the tax savings ? I’m thinking maybe just set his fund up under my name then drip feed when he needs money for uni, travelling or first home deposit.

LikeLike

I would start a discussion with the kid about that money at an early age. We will talk about how to should we use that money and try to guide him/her to the right direction. I think it is a good way to teach your kid about money. If you are confident about them handling that money, you pass it to them. If you think they are not ready, you can still hold on to it.

LikeLike

Pingback: The Best Way to Invest for Your Children in New Zealand – What You Need to Know | The Smart and Lazy

Pingback: The Best Way to Invest for Your Children in New Zealand – What to Invest | The Smart and Lazy