I’ve got the latest Auckland Council rate bill earlier this month and the council rate went up again. As an Auckland rate payer, you will have a choice to either payment annually or quarterly. If you choose to pay annually, you will have a massive discount of… 0.83% on your bill.

Thanks, Phil

It got me thinking: how should other rate payers and I decide if we should pay annually with that discount or quarterly without a discount? Will that discount big enough to offset my lost interest? What sort of return on investment do I need if I plan to pay quarterly?

Not a Simple Math

I was discussing this problem with a friend and he said, “it’s really easy to work out, just take the discount you’ve got from the council and compared that to your bank interest rate. If your interest rate is higher, keep your money at your bank.” I know there are some people using this method as their back-of-the-envelope calculation. However, it’s a bit more complicated than that. We will need to fire up excel to analysis this.

Prerequisite

Before we jump into the analysis, we need to check on two things:

- Will you benefit from the service for the next full year?

- Do you have to cash to do either option (pay annually and quarterly)?

If you answer no to either question, you should pay quarterly. There is no point to pay for something you know you are not going to use or enjoy. In the context of Council rate bill, I am planning to own this house for the next year, so I’ll benefit from this payment. I also have to cash to do both as I’ve been expecting this bill.

Two Choices: Annually and Quarterly

The difference between pay annually and quarterly is how are they are going to affect our cash position and the interest gain from that cash. If we pay annually up front, we will take a hit on cash but rewarded with a small amount of surplus cash from the discount. That cash can sit in the high-interest account to earn interest. On the other hand, if we pay quarterly, we will have more cash to earn interest at the beginning.

Here is the assumption in our analysis:

Cash on Hand: $2,500

Quarterly Payment Amount: $625/Quarter

Annual Payment Amount: $2,479.25

Discount on Annual Payment: 0.83%

Serious Saver Interest Rate: 2.2% (not change during the year)

Resident withholding tax rate: 33%

The quarterly payment is $625/quarter, so the total cash included in this analysis will be $625 x 4 = $2500. I used BNZ rapid save account as our serious saving account here. (By the way, BNZ Rapid Save is one of the better serious saver accounts out there.) The interest rate is at 2.2% and its allow one withdraw per month without losing the bonus interest.

Pay Annually: If we pay annually up front, we will have $20.75 in cash after discount. We will keep those cash in a serious saver account for a year and the amount of the end of the year will be $21.06.

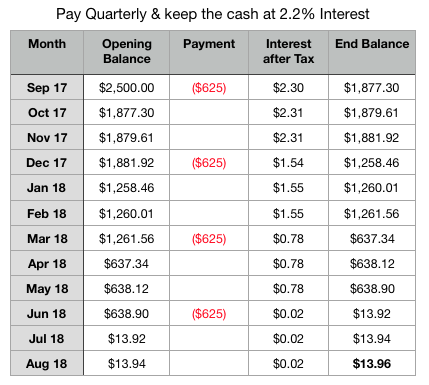

Pay Quarterly: We will start with $2,500 cash and pay out $625 every 3 months. All cash will keep in a serious saver account. The interest generates more interest in the beginning as the cash level was higher. Towards the end of the year, the remaining cash amount at $13.96.

Therefore, if you keep the cash in a serious saver account with 2.2% interest, you will be better off to take the annual payment discount.

Breakeven Point

If we keep increasing the interest rate (or expected rate of return), pay quarterly will eventually yield better return for your money. The reason is when we pay quarterly, the cash we kept in the beginning of the year is able to generate enough interest to offset the discount from paying annually. Check out the chart below.

After some boring math (get equation on both lines then apply quadratic formula), the breakeven point is at 3.33%. Therefore, in the context of Auckland Council rate bill with 0.83% up he front discount, you should pay quarterly if you can get over 3.33% pre-tax return (2.23% after-tax or tax-free) on your cash. Any rate below 3.33%, you should just pay annually and take the discount.

After some boring math (get equation on both lines then apply quadratic formula), the breakeven point is at 3.33%. Therefore, in the context of Auckland Council rate bill with 0.83% up he front discount, you should pay quarterly if you can get over 3.33% pre-tax return (2.23% after-tax or tax-free) on your cash. Any rate below 3.33%, you should just pay annually and take the discount.

When you Should Pay Quarterly?

You may think it is not hard to get an investment return over 3.3% given you can get a similar return on term deposit (3% – 4.2%), or index fund around 6%. However, the time frame is only 1 year, and you will have to withdraw part of them out every 3 months. So index fund is out of the window because expected return in a single year can be between 25% to -25%. A term deposit is not an option as well as you can’t take part of the money out every 3 months.

The better choice I can think of is Offset Mortgage on Home Loan. You keep more cash in your account to offset mortgage interest fits all criteria. The return is tax-free and guaranteed at around 5.75% plus you can access your cash every 3 months. To do that, you’ll have an existing home loan and had set up with offset mortgage or revolving credit.

Other good options include:

- Pay off consumer debt – very high return, but you will have existing consumer debt in the first place

- Top up KiwiSaver for member tax credit – very high return, not available if you are full time employed

- SuperLife NZ Cash Fund – better than bank return, 7 years after tax and fees return at 2.62%, can easily get your money out, not recommended if you are not existing SuperLife investor

In my opinion, if you don’t have offset mortgage and consumer debt, just pay it off up front. It’s easier, and you don’t have to deal with the bill every 3 months.

Insurance: Annual vs Monthly Payment

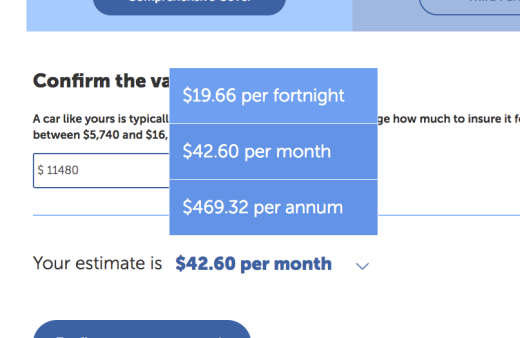

The same analysis can apply to insurance payment. Most Car, house, and contents insurance will provide different payment options. Check out the example below for a car insurance quote.

The discount from insurance company are much better at (42.6 x 12 – 469.32)/(42.6 x 12) = 8.19%. If we apply the same analysis, here is the result.

Pay up front have a superior return on your cash and the breakeven point is at 28.5%. I don’t think there is any investment options other than paying off a high-interest loan can top that. Therefore, if you have the cash and you will benefit from the insurance for a full year, you should pay annually on your insurance.

Here is a simple graph that shows the break even return rate on different payment discount.

You simply look at the annual payment discount and refer to the break even return rate to decide if you should take the annual payment discount. For example, you’ve got a 7% discount if you pay your house insurance annually compare to monthly. According to the graph, if you have an investment with 24% pre-tax return (like use that money to pay off the credit card), you should pay monthly.

Conclusion

- Pay quarterly if you don’t have the cash or not going to benefit from the service for a full year.

- With Auckland Council rate, pay annually if the 1-year return on your cash is below 3.33%.

- If you have existing consumer debt or offset mortgage facility, pay quarterly on council rate and use the cash to pay off or offset your loan.

- Insurance usually offer a great annual payment discount so try to pay annually if you can.

Email thesmartandlazy@gmail.com or follow me on Twitter @thesmartandlazy if you have any questions.