Sharesies is rolling out their trial run (a.k.a beta) investments options couple weeks ago. I’ve got their invitation recently and checked out their offerings. Sharesies is currently offering six SmartShares ETFs for their investor including NZ Top 50, AUS Top 20, US 500, NZ Bond, NZ Property and AUS Resources. You can check out their current offers here.

What is Sharesies

Sharesies is a New Zealand financial start-up company supported by Kiwibank Fintech Accelerator. They are an investment platform where users can make investments with small amounts of money. One of their mission is to make investment fun, easy and affordable.

The main selling point of Sharesies is by paying a $30 annual fee, an investor can invest into multiple investments with the minimum at just $5. Also, there is a $20 credit for the early Beta investor.

Invest $5 into ETF

In comparison, SmartShares ETF initial investment is $500, set up cost is $30/ETF and monthly contribution minimum is $50. So Sharesies is a great way for beginner investor to invest in a small amount into many low-cost, diversified ETFs. It bypasses the $500 initial investment and $30 set up fee with each ETFs.

On the other hand, SuperLife also offers the same ETF in their investment fund with a different management cost. You can check out the detailed comparison here.

While Superlife also doesn’t require initial investment and the minimum contribution can be just $1. How does Sharesies stack up to SuperLife and SmartShares on ETF investing?

Sharesies vs SuperLife & SmartShares

I’ve picked two popular ETF, NZ Top 50 and US 500, to run an analysis for 60 months (5 years). The analysis will compare the result on different contribution level(low and high contribution) for all three services. The low contribution will be at Sharesies minimum requirement, $30 initial investment (for the annual admin fee), $20/month contribution (about $5/week); The high contribution will be at SmartShares minimum requirement, $500 initial on each ETF, $50/month conditions.

NZ Top 50 ETF at low contribution

Here is the fees structure on the ETF

This is the amount of low contribution and expected return

So Sharesies have a higher admin fee ($30) and ETF management cost (0.50%), so its expenses should be higher then Superlife NZ top 50 ETF. Since Sharesies are aiming for beginner investor, I put around $5/week as a low-level contribution. The $30 initial investment cost is to cover Sharesies annual fee. Smartshares will not be included in this analysis as the investment amount is too low.

Here is the investment return each year

Superlife did better as it has a lower management fee and admin fee resulted in a higher return for the customer. The 5-years different is $135.81, 8.4%.

NZ Top 50 ETF at high contribution

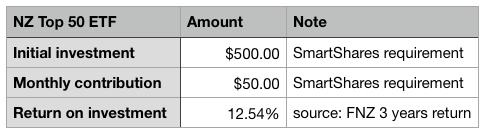

This is the amount of high contribution and expected return

We increased the contribution to $50/month, put $500 as an initial investment and include SmartShares into the mix.

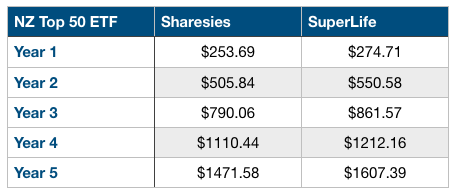

Here is the investment return each year

SmartShares came out on top despite the fact that they have a higher management cost. The main reason is that Smartshares don’t have an annual admin fee while Superlife charges $1/month. However, if you wish to cash out those Smartshares at this stage, it will cost you at least $30.

The difference between SmartShares and Sharesies is $163.34, 3.3%. Although both services have the same management cost, Sharesies charge $30/year admin fee which brings down the balance.

US 500 ETF at low contribution

Here is the fees structure on US 500 ETF

This is the amount of low contribution and expected return

This is more interesting as Sharesies have a lower management (0.31%) cost compare to Superlife (0.44%).

Here is the investment return each year

Due to the small amount of holding, the lower management cost (0.35%) did not cover the higher annual fee ($30) with Sharesies. Superlife holding was $122.28 more then Sharesies in year 5, 8.1%.

US 500 ETF at high contribution

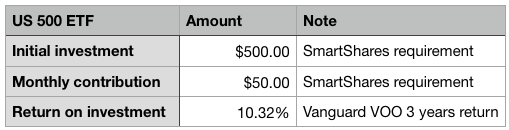

This is the amount of high contribution and expected return

Now we will do the same thing by increasing the investment to Smartshares minimum requirement.

SmartShares USF came out on top with no annual fee and lower management cost. The different between SmartShares and Sharesies at year 5 is $154.75, 3.3%. The different to Superlife is $41.5, 0.9%.

In both scenario, Investor with low contribution level and better with SuperLife. If you have the $500 and $50/month to invest, SmartShares is the cheaper way. (Although I will suggest going with Superlife on NZ top 50. I’ve already covered that in another post)

How about portfolio building?

Since Sharesies investors can bypass SmartShares setup fee and initial investment requirement. So Sharesies is actually a great tool to build a simple portfolio. I will use US 500 ETF, NZ Top 50 ETF and NZ Bond ETF to build a portfolio.

Here is a balanced portfolio you can easily build with Sharesies. 25% NZ Bond, 37.5% US 500 and 37.5% NZ Top 50. If we keep the low contribution at $20/month, you can put $5 in NZ Bond, $7.5 in US 500 and $7.5 in NZ Top 50.

If you wish to set up something similar in SmartShares, you will have to spend $30 x 3 =$90 on set up fees, at least $500 x 3 = $1500 initial investment and $50 x 3 = $150/month contribution. Not feasible at all.

SuperLife, on the other hand, as my best pick for portfolio builder in New Zealand can easily build the same portfolio. Let’s check out the cost difference.

Here are the contribution and return

Here is the investment return each year

Superlife still edged out at year 5 with $123.15 more, 8.2%. I didn’t do a high contribution comparison here because SmartShares are really not fir for portfolio building.

Conclusion

Based on the analysis, SuperLife is still the better choice on low contribution and most of the high contribution (except US 500 ETF) regarding cost. However, I still think Sharesies is doing something good here.

Sharesies is promoting to young Kiwis who never invested before by providing a straightforward and easy-to-use app. The sign-up process is simple and painless. The interface is robust and delightful. They’ve done an excellent job on explaining each investment options to beginner investment and make it accessible. Check out the screenshots below.

I don’t mind about the $30 admin fee if that what’s it take for a newbie to start investing for their future. I’ve been telling readers to spend $12/year on Superlife as they have a better user interface and functions over SmartShares. Sharesies interface and user experience are way better than both of them. They made investing as easy as shopping online, which should bring a lot of people into the world of investing.

Sharesies are still in beta, so there are some functions are missing, like reinvest and auto allocation. I am sure Sharesies will continue to improve on their functions and brign in more investment options. Hope more companies like Sharesies will pop up in New Zealand to bring more people into investing.

More investor, bigger the market size, lower the cost!

Email thesmartandlazy@gmail.com or follow me on Twitter @thesmartandlazy if you have any questions.