Simplicity, the non-profit and low-cost KiwiSaver provider introduced a new fund last week called “Guaranteed income fund.” Guaranteed income investment products had been around for years in other overseas markets, but it’s very new to New Zealand. So in this blog post we will look at what is guaranteed income fund, how does it work, the pros, the cons and do you need it.

What are Guaranteed income fund and annuity

The guaranteed income fund is basically an annuity. They provide a stable and secure source of retirement income. You will need to surrender a sum of money in exchange for a stream of income that’s guaranteed for life. The annuity has been around for a very long time in the overseas market. Usually, annuity service is offered by an insurance company because there is a guaranteed element in this product. New Zealand just had our first annuity service from LifeTime Income Ltd not long ago.

How does it work?

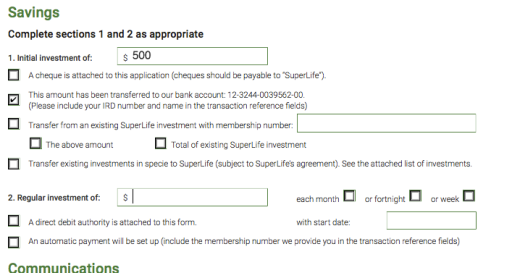

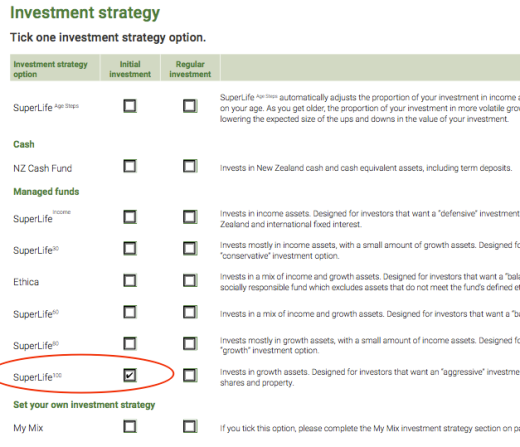

Simplicity now partners with Lifetime Income Ltd and provide a guaranteed income fund that offers 5% guaranteed return at age 65 for the rest of your life. The minimum amount is $50,000, the annual cost is $30, fund management cost is 0.31%, and insurance cost is 1.3% of your protected income base. Protected income base is your initial investment if you start receiving cash payment immediately. If you decided to delay receiving the cash payment, your protected income base would be either your initial investment amount or the current fund value, whichever is higher. We will explain that later.

You can think of it as you borrow some money to another person. That individual will keep paying you interest at 5% for the rest of your life.

Here is an example of how it works. Assume you are now 65. You decided to put $50,000 into Simplicity Guaranteed income fund and start receiving the cash income immediately. Every year, you will receive 5% of that $50,000, which is $2,500. It will payout fortnightly at $2,500 / 26 = $96.15 for the rest of your life. The $50,000 are still with Simplicity as an investment. That money will continue increase or reduce according to how the investment market performs, tax and fee charges. The cash you receive will also come from that fund as well.

Here is a simplified calculation

Your capital + gain or loss from investment – tax – annual fee ($30) – management cost (0.31%) – Insurance cost (1.3% of initial value) – cash payout (5% of initial capital) = end balance

Apply that to our $50,000 example with 6.5% return, Taxed under FDR rule with PIR at 17.5%, here is the performance for the first year.

Initial Capital $50,000 + Investment return $3,250 – Tax $465.94 – Annual fee $30 – management cost $163.63 – insurance cost $650 – cash payout $2,500 = End year balance $49,440.43

Here is the performance for next 25 years with the same return at 6.5%

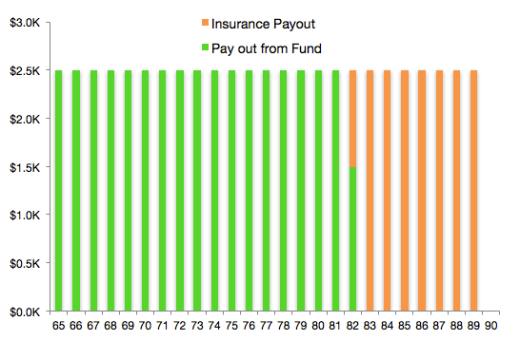

Here is the graph of your fund value over the years.

What if my fund runs out?

As you can see with 6.5% return, your fund value will keep going down, and you will run out of money some day. If your investment fund is exhausted, there will be no money to draw from. At this point, the insurance policy will take over and pay out that guaranteed amount ($2,500/year) for the rest of your life. That’s why there are a 1.3% insurance charges on the fund.

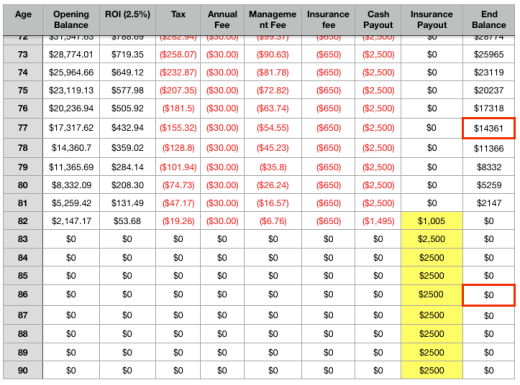

Now I will use the same example but lower the return on investment to 2.5%.

Your investment fund exhausted age 82. You can only draw $1,495 from your fund at that year. The insurance company will pick up the tap and continue to pay the guaranteed income for the rest of your life.

Here is a closer look at guaranteed income. Insurance policy kicks in at age 82 and continue.

Can I delay and get more Cash Payout?

The 5% is the minimum income guarantee. It goes by 0.1% each year that you defer taking out the guaranteed income. When you start getting the income at 65, the guaranteed rate is 5%; if you start getting it at 70, the guaranteed rate is 5.5%. It tops at age 90 with 7%. The money in the fund will increase or decrease with the investment return but there is no cash withdraw.

Here is an example when you join at 65 but only start to get income at 70 and get 5.5% guaranteed income.

What if the receiver pass away?

If the receiver passes away, whatever left in the account will be passed on to their estate. Now, let’s go back to our 2.5% return example.

If the receiver passes away at age 77, there are still $16.962 capital in the account. That amount will pass onto receiver’s beneficiary. On the other hand, if the receiver passes away at age 86, there will be no money left in the fund. So there will be no money to receiver’s beneficiary, and the insurance payment will stop.

What so good about Guaranteed income fund

Imagine you are now retired and you only living on superannuation plus your saving. Every time you spend money on the power bill, water and food, your retirement saving go down a little bit. Do you worry you may outlive your retirement savings and have to live on superannuation alone? This is a real concern for many retirees and it reduces their spending in retirement years.

Below is the typical situation for New Zealand retiree. Their retirement is partly funded by superannuation and their own savings/income to reach their ideal standard of living.

Since we don’t know how long we are going to live, some retirees worry they may outlive theirs. So they reduce their spending and stand and hope the saving will least long enough. The living standard reduced as a result.

Since guaranteed income fund and annuity provide a steady stream of income for life, it is a powerful tool for retirees. You can surrender part of your retirement saving and exchange for a guaranteed income for life. Add that on to superannuation from the government, you will have a bigger part of fixed income every fortnight. So it will help to bridge the gap between your living expenses and superannuation. Also, It will reduce the concern if you will out the saving. The most significant benefit its gives you the certainty that you can always fall back to Superannuation + guaranteed income level.

What are the Limitation & Risk

There is always a catch with investment and insurance products. There are certain restrictions and risk regarding guaranteed income fund.

KiwiSaver Only – currently this fund is only open to the KiwiSaver member. If you are not eligible for KiwiSaver or you already left KiwiSaver, you can’t join the fund. Also, you’ll have to be 65 to start receiving a cash payment. Alternatively, you can get the annuity from Lifetime Income with a higher cost.

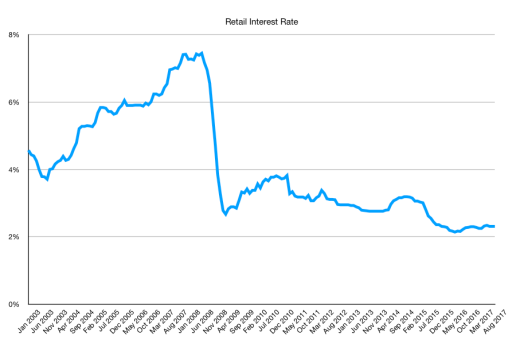

Fixed amount – It is great that you will have an income for the rest of your life. However, that amount is set for life as well. So inflation will be your biggest problem. With inflation, the same amount of money will have less buying power. In the early 2000s, the price of petrol was well below $1. I can fill my tank for $30-$40. Now, I can only fill 60% of the same tank with $40. Here is a table of the real value for $2500 after 2% inflation. 10 years in at age 75, that $2500 will worth about $2000 today, it lost about 20% of its value.

Since the cost of living and superannuation are rising along with inflation, you will have to fund more of your living expenses out of your retirement savings. Just like the graph below.

However, people tend to spend less as they age. Although the cost of living increased, the cost for an ideal living standard will decrease and it softens the effect on inflation.

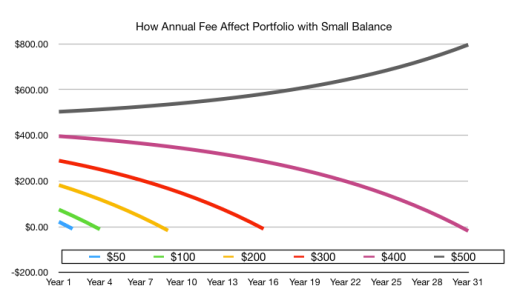

Cost: This fund is very similar to Simplicity balanced fund and they have the same admin fee and management cost. However, guaranteed income fund have an insurance policy attached to it and it cost 1.3% of your initial fund amount. No matter how your fund performs, it will charge the same amount of insurance fee.

Insurer risk: Since this fund has an insurance policy, there is always the risk of insurance company collapse. The insurer is Lifetime income limited, which is not a big insurance company like AIG.

Access to fund: You will need to surrender a large sum of cash to the investment provided to start your income guaranteed fund. There are limitations on how you can withdraw your fund from the plan. First, your fund may not have enough money due to the fees and investment return. If there are fund to pull out from, you can either withdraw up to 20% of your fund and take a pay cut by the same percentage you took out. The other options are completely empty your fund. The good thing is Simplicity will not charge a fee on that.

Do I need it?

I think it’s great that there is one more option for New Zealand retirees with Guaranteed Income fund. It will reduce the concern of retirees outlive their savings and provide a fallback for them if they have to scale back their spending.

Make sure you understand Guaranteed Income fund is just one of the many options for retirees and you should not put all of your eggs in one basket. I will include them as part of the retirement plan along with term deposit, investment fund or property and superannuation.

The key point is you should not put all of your money into Guaranteed Income fund and annuity. One way to work out how much guaranteed income you’ll need is to decide how much income you wish to be guaranteed along with superannuation income.

For example, a married couple will get $1200.60 each fortnight. They also worked out their ideal living standard will cost them $2350 each fortnight including nice food, shopping, dining out, travel and avocado on toast every Sunday. On the other hand, we can cover their basic expenses (power, water, communication, petrol and basic food) for $1500 each fortnight.

If the couple wants to the guaranteed income cover their ideal living standard, the guaranteed income needs to be $2500 – $1200 = $1300 each fortnight. To get that amount of guaranteed income, the couple will have $1300 x 26 / 5% = $676k in the fund. That is not a small amount for most people.

How about we just need to cover the basic. The guaranteed income will be $1500 – $2500 = $300 each fortnight and the fund value will be $300 x 26 / 5% = $156k. This amount is not too big and seems reasonable to average retirees. It will cover the basic for the couple at their early stage of retirement. They will be happy to know if anything happens that cost all of their life-saving, they will still have enough to cover the basic living with superannuation and guaranteed income. They can even increase the fund value to hedge against inflation.

Conclusion

- Simplicity offer Guaranteed Income fund for the KiwiSaver member.

- The investment fund is similar to Balanced fund with $30/year admin fund, 0.31% fund management fee and 1.3% insurance cost based on the initial fund value.

- Investors will receive 5% of the initial fund value as cash payment every year from 65 for the rest of their life.

- The cash payment is drawn from your investment fund. If the investment fund runs out, an insurance policy will kick in and provide the cash payment.

- This is a great option (in combine with superannuation) for retirees to set a safety income line.

- Do not over commit. This fund should be part of your retirement plan along with superannuation, term deposit, and other investment.