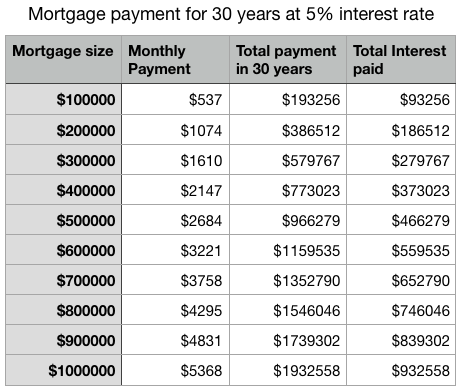

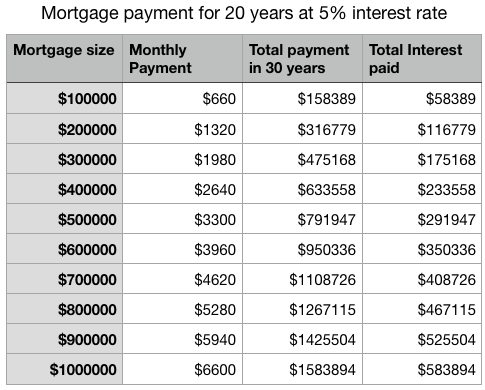

Do you know how much interest you are paying on your mortgage? No, I am not talking about the interest rate. How much interest in the dollar amount you are paying on your mortgage? Also, what proportion of your mortgage payment goes to interest? Do you know how many years it will take to pay off half of your mortgage? (spoiler: more than 20 years with 5% interest rate)

Most home owners know their mortgage payment like the back of their hand, but not all of them can tell you how much interest is in the payment. Some new house owner is surprised when they read the mortgage statement and found out how little money went to mortgage repayment. Let’s look at the interest and principal on our mortgage payment. I will be focus on the simple interest mortgage with a fixed interest rate and fixed payment amount for 30 years.

Interest and Principal

Every mortgage payment in New Zealand will contain Interest and Principal.

The principal is the part of your mortgage payment that goes to repay the amount you borrowed. It starts out with a small amount and increases on every payment. Eventually, the total principal paid will be equal to the amount you borrowed.

The lender (usually Bank) took up risk to borrow you money on a house purchase. Interest is the reward for taking that risk. They are profit for the lender and expense for the borrower. Interest rate could be different for each different borrower. Usually, a low-risk borrower will have a lower interest rate compared to a high-risk borrower. At the lender’s point of view, to take a higher risk borrower, they will charge higher interest to compensate that risk. A significant amount of mortgage payment will go to interest payment at the beginning of the mortgage and decrease on every payment.

Proportion of interest and principal on a 5% interest, 30 years mortgage

How Much Interest you are paying?

We will use the following simple interest mortgage as an example.

Mortgage size: $500,000

Term: 30 years, pay monthly

Interest rate: 5%

Monthly payment: $2,684.11

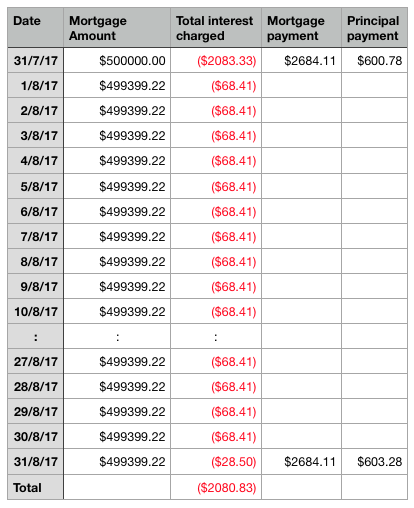

For your first payment, $2083.33 will go to interest and only $600.77 will go to principal payment. That’s 77.6% of your monthly payment go to interest expenses.

Breakdown on your mortgage payment during the first year

For the first year, you will pay $32,209.30 in mortgage payment, $24,832.47 will go to interest, and you only reduce your mortgage by $7,376.83.

Why most of your payment went to interest in the beginning?

You may be surprised only 23% of your mortgage went to principal payment and wonder why most of your payment went to interest in the beginning. I was angry and thought it wasn’t fair. So I dug in and worked out how the banks come up with that amount.

First, under the terms of the mortgage, interest is calculated daily and compounded monthly. What it meant was the bank will charge interest on the mortgage every day and recalculate the mortgage amount and interest every month. The interest rate (5% here) is an annual rate, so one day of a 5% interest will be 5% / 365 = 0.013699%. Bank will apply that one-day interest rate to your current mortgage amount $500k. At your first month, you will be paying $500000 x 0.01369% = $68.49 every day on interest. Here is the daily breakdown on the first month of the mortgage.

You may notice on 31/7, the interest amount is only $28.54. The reason is that when we calculate the monthly mortgage payment, we are not calculated based on how many days in a month. We just divided the full year (365 days) by 12, so every payment got 30.41667 days. That’s why I have to re-adjust the 31st day of July interest by 0.41667. $68.49 x 0.41667 = $28.54.

On 31/7, you pay $2684.11 for your mortgage. At this point, the total interest is $2083.33, only $2684.11 – 2083.33 = $600.77 go to reduce the $500K mortgage. At 1/8, your new mortgage amount will be $499,399.89 and you daily interest will be $499,399.89 x 5% / 365 = $68.41. At the end of the month, we will accumulate $2080.83 in interest. By paying the same amount of mortgage payment ($2684.11), you will reduce the mortgage by $2684.11 – 2080.83 = $603.28.

When you compare the numbers on both months, your monthly payment amount is the same. Since you reduce the mortgage amount by a little bit in your first payment, the interest on the mortgage at the 2nd month will be reduced. That explains the interest payment will keep decreasing and principal payment keeps increasing. The reason we why most of your payment went to interest payment is because your mortgage amount is high in the beginning. Lots of interest was charged and most your payment went to pay off those interest.

How does pay extra on your mortgage reduce the interest calculation

In my last post, I said one thing you can do to reduce the interest paid on your mortgage is by paying extra on the mortgage. Let put that in our example and see how $100/month extra can reduce the interest.

The first month will be the same as we haven’t made any payment. We will still have $2083.33 interest needs to pay. However, if we increase the monthly payment to $2183.33, we will reduce the mortgage amount by $2183.33 – 2083.33 = $700.78. On your second month, the new mortgage balance is $499,299.22 and the daily interest will be $499299.22 x 5% / 365 = $68.40. At the end of the month, we will accumulate $2080.41 in interest, $0.42 less.

You may think that just $0.42, hardly make any difference. However, that is the saving on the second month only. You will save more and more each month. Paying extra on the mortgage will have a knock on effect on the mortgage amount reduced. You will end up pay off your mortgage in 27.6 years and saved $42.6K on interest.

Breakdown interest paid by years

Now we took the $500K mortgage break it down by years. Here is what you will pay over 30 years.

Some interesting facts here:

- 77% of your first-year payment went to interest.

- By the end of the mortgage, you will pay $500K on principal and $466.3K on interest. You almost paid twice on your mortgage.

- For the first 16 years, over 50% of your payment will go the interest.

- You will pay almost half of the total interest on the mortgage in your first 10 years. Therefore, lenders make half of their profit in 1/3 of the time.

- After paying 20 years, you still owe over 50% on your mortgage.

- You will pay off $253K in the last 10 years of the mortgage.

That’s why Bank love mortgages, and it’s their bread and butter. I personally feel angry reading those facts. I put reducing mortgage as my top financial priority. On the other hand, inflation is another factor helping to reduce the ‘real’ cost of the mortgage, we will get into that in another post.

If you want to find out the breakdown on your mortgage payment, you can check out this mortgage calculator on mortgagerates.co.nz.

Email thesmartandlazy@gmail.com or follow me on Twitter @thesmartandlazy if you have any questions.