(The information in this post is not longer up-to-date. Please check the most recent update here)

In case you don’t know, I am in the camp of passive low-cost investing. So most of my investment are in ETF and index fund.

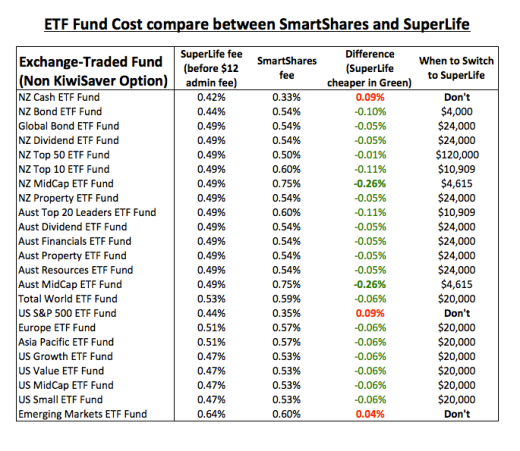

Currently, the easiest way to buy and hold ETF in New Zealand is with SmartShares and SuperLife. Both companies are owned by NZX and they are selling basically the same ETF product. However, the cost of the ETF are different with those 2 companies and I’ve put together a table to compare them.

In general, SuperLife offers lower fund management fees. However, they do charge a $12/year admin fee which makes SuperLife more expensive when you are starting out. You should, therefore, start with SmartShares and once your hold reaches the “When to Switch” amount, you can move your fund to SuperLife to enjoy the lower cost and the better user interface.

My table is based on the assumption that you have only 1 fund in SuperLife. If you have multiple funds with SuperLife, that $12 admin fee will be shared by those funds and you can divide the “Switch to SuperLife” amount by the numbers of funds you’ve got.

Here is an example:

You are holding $15000 Global Bond ETF and $12000 Aust Property ETF with SmartSshares. Both of them alone did not pass the “When to Switch” limit. However, if you switch both of them to SuperLife, the “When to Switch” will be divided by the numbers of funds, which is 2, and the new “When to Switch” amount will be $24000/2 = $12000. You should, therefore, switch both of them over to save fees.

Email thesmartandlazy@gmail.com or follow me on Twitter @thesmartandlazy if you have any questions.

I’ve been looking at investing in smartshares but I am currently unsure. What is your opinion on the trade volumes of smartshares, most specifically the S&P500 fund?.

I’d like to invest heavily in this but I am afraid that when it comes time to withdraw from the fund, i’ll struggle to unload the shares and get my cash.

LikeLike

Yes, after some help from reddit forum and facebook group, there are market maker for USF who will buy your share if you wish to unload it.

LikeLike

How easy is it to switch from Smartshares to SuperLife?

LikeLike

You will need to open a broker account (cheapest one are ANZ and ASB) and sell the share on open market. The broker will chage you a fee (minimum $30/$29)

LikeLike

So, if I understand you, to switch from Smartshares to Superlife I will need to:

1. Open a broker account

2. Sell all my shares with Smartshares

3. and buy them back again with Superlife?

LikeLike

Yes, correct

LikeLike

Thought it be easier than that…also with the selling and buying that has to take place you might end up either loosing or gaining some shares…depends on the market. Overall, its a process that might put some people off. Thanks.

LikeLike

Pingback: Compare ETF fund cost between Superlife and Smartshares (2017 Update) | The Smart and Lazy