Recently a tax accountant contacted me regarding my post on comparing cost on ETF investing between SmartShares and Superlife. He pointed out that apart from the admin fee and management cost, investors also need to consider the tax implication when investing. I’ve known about this issue but did not include on my blog because I did not fully understand the rules. After I’ve asked around and done some research, here is my finding on different tax treatment on SmartShares and Superlife ETF and why does it matter to New Zealand investor.

Disclaimer: I am NOT a tax accountant or expert. In fact, I am pretty bad at tax despite I’ve done a couple tax papers at university. So what I am going to say would be incorrect. If you notice anything wrong in my blog post, please let me know and I will correct that ASAP. You should contact a tax accountant or IRD for tax advice.

What are PIE and PIR?

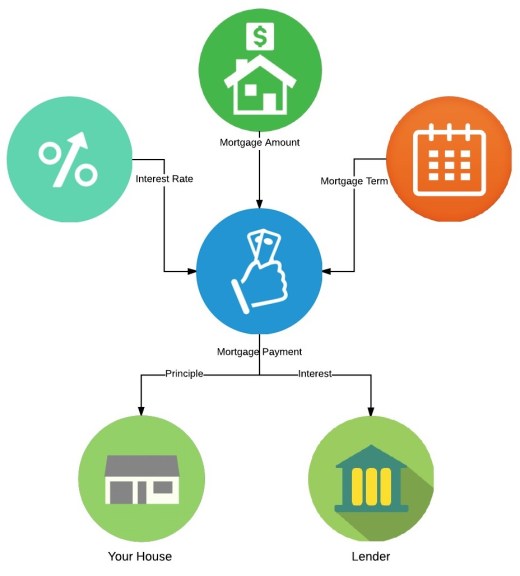

According to IRD website, a portfolio investment entity (PIE) is a type of entity, such as a managed fund that invests the contributions from investors in different types of investments. Eligible entities that elect to become a PIE will generally pay tax on investment income based on the prescribed investor rate (PIR) of their investors, rather than at the entity’s tax rate.

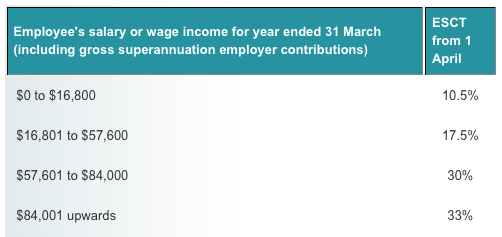

Prescribed investor rate (PIR) is the tax rate that PIE fund use to calculate the tax on the income it derives from investing your contributions. It based on your taxable income, e.g. income from salary, wages and any additional sources of income (including the income from your investment) that you would include on your income tax return.

For an individual, your PIR can be 10.5%, 17.5% and 28%. Check out IRD web site to work out your PIR rate.

How PIE Works?

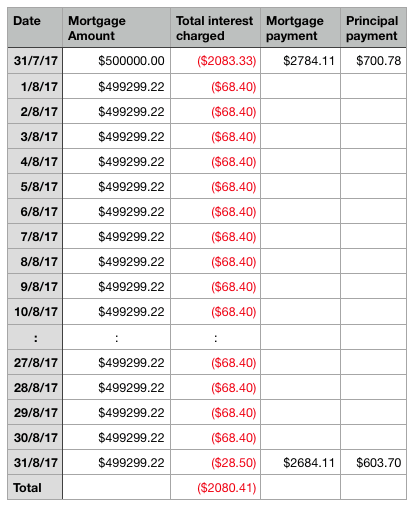

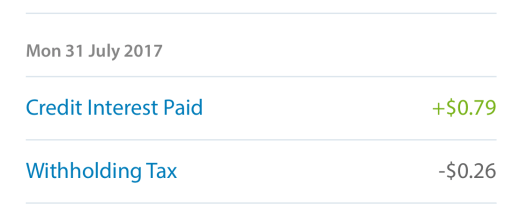

I will explain PIE with ‘interest on saving account’ as an example. You usually received interest by saving money in a bank account. If you look closely at that interest transaction, you can see the bank gave you some interest, then IRD take away some as ‘Withholding tax’. Check out the transaction below.

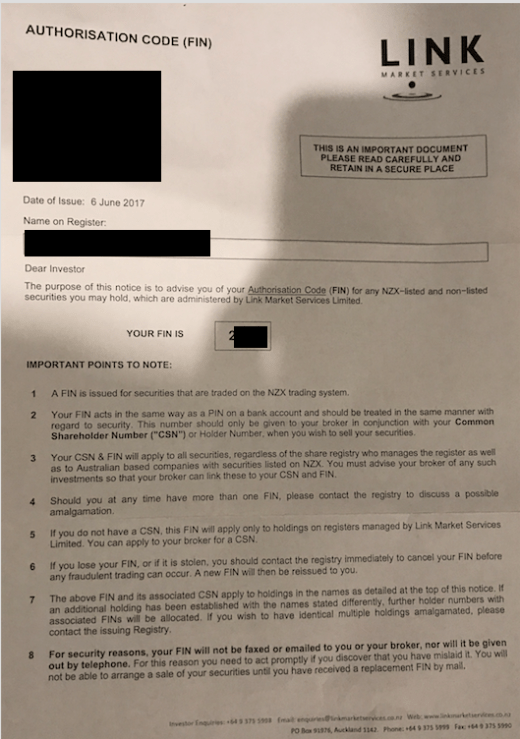

So I earned $0.79 in interest, but IRD took $0.26 away. The amount decided how much IRD can take is based on my Resident withholding tax (RWT). In this situation, the RWT is 0.26/0.79 = 33%. You can work out your RWT here.

For people who are having a full-time job, their RWT rate will likely to be 30% or 33%. That’s where PIE come in. The most common PIE fund you will see is the PIE account at your Bank. There are ANZ PIE Fund, Term PIE at BNZ, PIE Funds at Kiwibank and Westpac Online Saver PIE.

If you put money in those PIE accounts, in stead of paying 30% or 33% on your interest earned, you will be paying the max PIR rate at 28%. So in my situation, IRD will only tax $0.22 on my $0.79 interest income. The amount may seem tiny here, but if you have $20,000 saved in a PIE Term deposit with 3.5% interest, you will just have to pay $196 on tax instead of $231.

Different PIEs with SmartShares and SuperLife ETF

There are different types of PIEs and we will talk about Multi-Rate PIE and Listed PIEs here.

Multi-rate PIE (MRP) is a type of PIE that uses the investors’ prescribed investor rates (PIRs) to calculate the tax on the investment income it earns from the investors’ contributions. Most PIEs are multi-rate PIE including SuperLife and Simplicity fund.

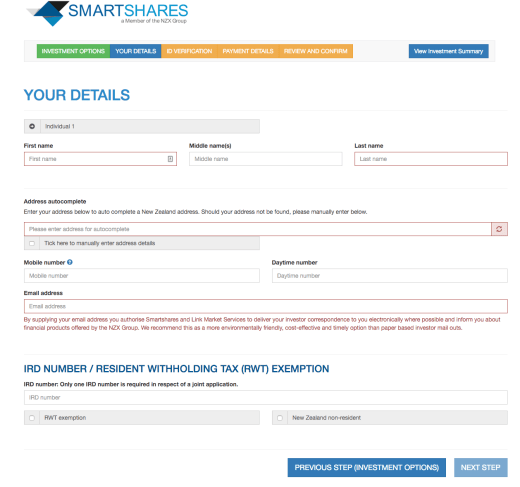

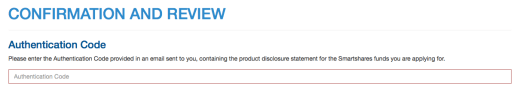

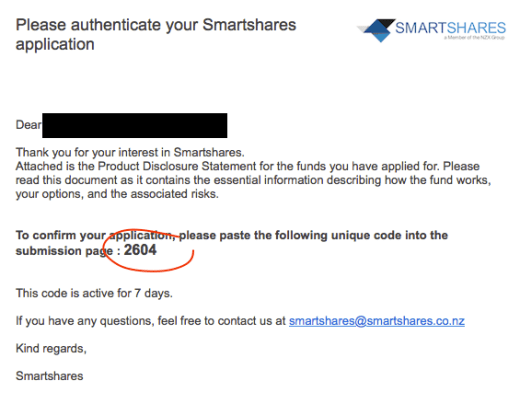

A listed PIE is a type of PIE listed on a recognised exchange in New Zealand, and they calculate the tax on a fixed rate regardless of investors PIR. SmartShares ETFs are listed PIE, and they will pay tax at 28%. Check out section 6 on SmartShares’ product disclosure statement.

So the main difference between those two investments are you will pay 28% tax on SmartShares ETF and with SuperLife ETF Fund, you will pay tax according to your PIR.

Why Does it Matter to Investor

An investor needs to work out their PIR so they can decide each provider is more tax efficient. You don’t want to overpay your tax. There are three different PIRs for individuals: 10.5%, 17.5% and 28%.

For people who earn over $48,000 a year for the past 2 years, their PIR will likely to be at 28%. In this case, there is no tax different between SmartShares and SuperLife ETF as you will pay 28% on taxable income with both funds.

For people who are on low or no income, their PIR could be at 10.5% or 17.5%. They can be students, children, part-time/casual worker, stay-home mum/dad and retirees. In this case, they will pay tax on their PIR with SuperLife ETF Fund while SmartShares will still charge 28% tax on them. Therefore, they will pay extra tax with SmartShares.

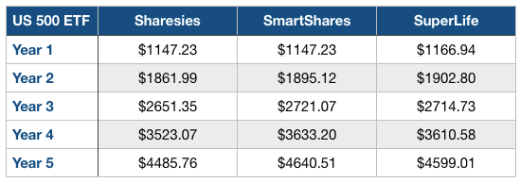

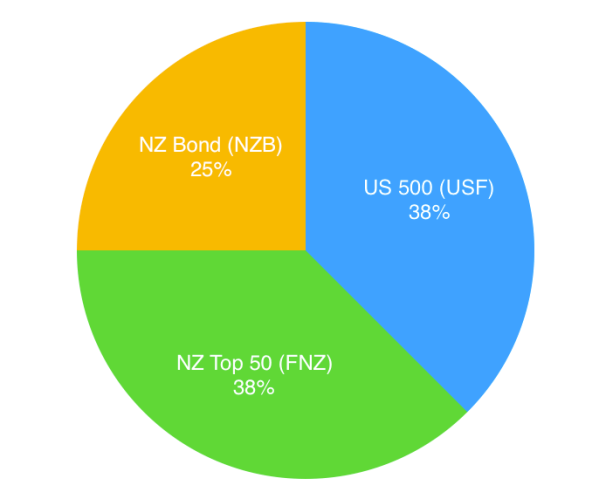

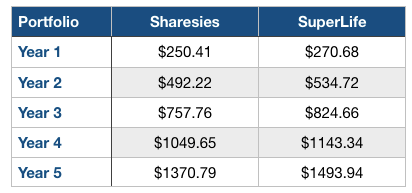

Here is an example on US 500 ETF valued at $20,000. We will compare the value after tax and fee with the different tax rate. Assume there was no contribution and no value change during the year. Taxable income calculated at 5% of the portfolio under FIF rule. Ignored Smartshares $30 setup fee.

Despite SmartShares have a lower management cost and no annual admin fee, investors with 10.5% or 17.5% PIR will end up better with SuperLife as they paid less tax. That’s more reason for you to choose SuperLife ETF Fund if you are on low PIR rate.

Conclusion

- If your PIR is at 28%, pick SmartShares or SuperLife based on cost, functions, and experience. In my opinion, SuperLife is the better choice for most ETF except US 500 ETF. You can check out my comparison here.

- If your PIR is at 17.5% or 10.5% SuperLife ETF Fund provide a better return due to the lower tax paid. The amount of tax saved will increase the value of your portfolio.

- Investor at lower PIR can get the excess tax back with a tax return.

- Since most of the investment funds are multi-rate PIE. It is essential you work out the correct PIR and submit that to your fund manager. You can work out your PIR here.

- Consult IRD or a tax accountant for tax advice.

Email thesmartandlazy@gmail.com or follow me on Twitter @thesmartandlazy if you have any questions.