I spent a lot of time here talking about investing in New Zealand. However, if I put my money where my mouth is, I spent more money on reducing my mortgage compares to investing. So let’s take a break from investing and talk about the mortgage, which is one the top three investment options in New Zealand.

We are one of the lucky ones who luck into a house before house price went batshit crazy between 2013-2016. However, since we brought Auckland, the mortgage amount is still huge dispute we put down more than 20% deposit. So reducing that mortgage have been my top priority and I spent a lot of time to research and study on mortgages. It turns out the mortgage is just a mathematical formula. If we understand the factor of that formula, how to pay off the mortgage early is not a secret at all.

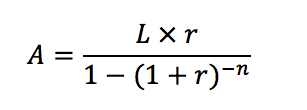

The Formula of Mortgage

A mortgage is a loan to buy a property. You borrow money from the lender (usually a bank), and you are obliged to pay back with interest. The lender uses the property as security. Here is the formula of Mortage.

A is the payment on each term.

L is the mortgage amount (or Principal)

r is the interest rate

n is the term

So the mortgage formula based on those four factors and they are interconnected. If you follow the mortgage plan and make the payment each term (usually every fortnight or month), by the end of the term, you will pay off the mortgage and plus interest.

(You don’t need to calculate the mortgage on your own. There are hundreds of mortgage calculator online, I recommend the Mortgage Calculator on Sorted)

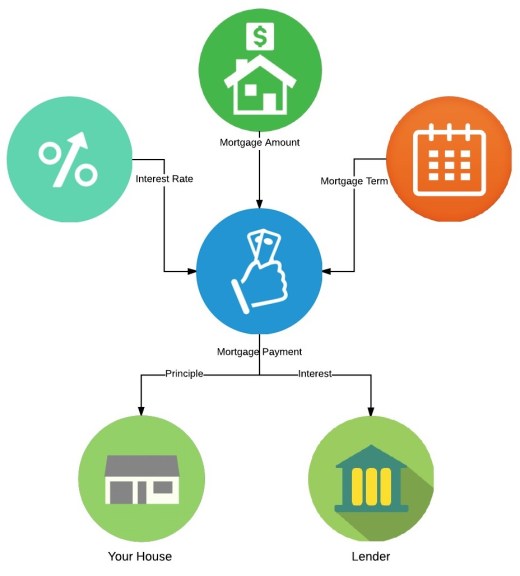

Interest and Principle

Each mortgage payment will have interest payment and principal payment. The principal is to repay the amount you borrowed, and interest is profit for the lender. At the beginning the mortgage term, most of the payment went to interest, and only a small part of the payment went to the principal.

To work out the total interest paid on the mortgage, you will need to:

Payment amount X No. of Terms = Total amount paid

Total amount paid – Mortgage Amount = Total Interest Paid

The Game of Mortgage

The mortgage is a game with four controls.

For me, the mortgage is just a game. It’s a game with 4 controls. The goal of the mortgage game is to minimise Total interest paid by changing payment amount, mortgage amount, interest rate and terms within your abilities. In New Zealand, the size of the mortgage can be range from $100k to $1mil or more. Total interest paid on the mortgage can be 30% – 130% of the size mortgage. This is a high stake game with $30k to $1.3mil of interest to be saved. Yet, the rule of the game is surprisingly simple!

We are going look into each factor and see how they affect our goal to minimise our total interest paid. We will be using the following mortgage as our default example. To keep it simple, I assume interest rate will stay the same during the whole period.

Mortgage size: $500,000

Term: 30 years, pay monthly

Interest rate: 5%

Monthly payment: $2,684.11

Total Interest Paid: $466,278.92 (93% of mortgage size)

Mortgage Amount

The mortgage amount is the main deciding factor in a mortgage. The amount you borrowed is in direct proportion to your monthly payment and total interest paid. More you borrow, more you pay every term and more paid on interest. However, the size of total interest paid compared to mortgage amount reminds the same. In our example, no matter the size of the mortgage, you are still paying 93% more on interest.

In most case, you want to borrow as little as possible.

5% interest rate and 30 years term, pay monthly

Interest rate

Interest is charged by the lender to the borrower to offset the risk of lending money. It calculated based on interest rate. Interest rate change from time to time due to multiple factors, including official cash rate change by RBNZ, the cost of borrowing at the lender, the length of the fixed term, demand of mortgage at each lender and more.

Increase interest rate in a mortgage formula will affect mortgage payment and total interest paid. If you took a 5% interest rate and increased that by 0.5% to 5.5%, the mortgage payment will increase by 5.8% but the total interest paid to mortgage ratio jump from 93% to 104%. So you want your interest rate as low as possible.

$500,000 Mortgage, 30 years term, pay monthly

Terms & Payment

The term is how long the mortgage supposes to last and payment is how much you will pay each time. I put them together because they are closely connected in a mortgage. If we increase the mortgage terms, the payment amount will be lower but you will pay more on interest. On the other hand, if we increase the payment amount, we will shorten the mortgage terms.

In the table below, you can see if we shorten the mortgage by increase our payment amount, we will be paying a lot less on interest.

$500,000 Mortgage, 5% Interest Rate

In Reality, What can you Change?

Now we understand those four factors of a mortgage and how they will affect the end game (a.k.a total interest paid). Let’s put them into a real world situation and see how we can change them to our favour. (There are many ways to improve those factors, I only covered the obvious one here)

Reduce Mortgage Amount

Since the mortgage amount decides your term payment and total interest paid, it’s better to have a smaller mortgage. With small mortgage amount, it will come with a small monthly payment amount. You can increase the monthly payment amount without adding pressure to your living budget.

To reduce the mortgage amount for potential house buyer, you will have to put down a larger down payment or choose a cheaper house.

For existing homeowner, you can reduce the mortgage amount when you mortgage terms are up for review by transfer some of your saving to repay that mortgage. (if you have the spare cash)

To be honest, it is difficult for both potential buyer and house owner to reduce their borrowing amount. With those crazy house price these days, most of the potential buyers are stretching to the maximum on what they can borrow and get onto the property ladder. Existing homeowners are already stuck with that mortgage and lender don’t like you pay them back early. So in reality, you don’t have much control on that.

(There are some tricks to reduce that mortgage with right mortgage set up. We will get into that in an upcoming blog post)

Get a Better Interest Rate

Bad news, you don’t have much control on interest rate either. The Interest rate set by the lender and each lender will have the identical interest rate. What you can do is make yourself a better borrower.

Banks love mortgages as this is their bread and butter. If you are a good borrower in their eyes, they will offer you a discounted interest rate to get your mortgage business. What consider a good customer from the Bank:

- Owner Occupied Property, mean the mortgagor live in that property

- Work full time with a stable income

- Employed by established company for a long time

- Clean credit history

- No other debt

- DINK (Double income, no kids)

- New Customer

- Willing to change your ‘Main Bank’

- Have 20% or more equity in the house

- A good quality house in a good location (not leaky home or potential leaky home)

Bank will consider that as a low-risk lending and happy to offer a small discount on the interest rate.

However, the free-market is still the primary deciding factor on the interest rate so there is not much we can do about that. Kiwis used to pay 18% interest rate in 1985. Before GFC in 2008, the mortgage rate was around 8.4%. We are experiencing a historic low in interest rate at 2017.

Increase Payment Amount & Shorten the Terms

Payment and terms are the most important factor in the game of mortgage because we have control over it. When the bank says you need to pay $2684.11 for your $500K mortgage, it’s not the absolute amount! It’s just the minimum amount you’ll need to pay. You can always tell the bank you what to pay more. Let’s see how the term and total interest paid change when we pay more on our mortgage.

$500,000 Mortgage, 5% interest rate. Minimum monthly payment at $2684.11.

By simply put $1/day extra into your mortgage payment ($30/month), you will shorten the mortgage by 9.6 months and save $13.8K on interest. If you can add $10/day extra into your payment, you can pay off your 30 years mortgage in 24 years and saved $106,644 in interest.

It may be hard to do in the first couple of years, but your income will likely to be increased while the mortgage payment stays the same. Combine that with careful budgeting and frugal living; you can put more and more into your mortgage and reduce the interest paid.

The Secret of Paying off Mortgage

Now you understand the four factors of the mortgage and how you can improve them. The secret of paying off mortgage fast and win the game of mortgage is very simple.

Get the smallest amount of mortgage with the best interest rate discount, pay it off with the biggest payment amount you can afford.

That’s the fundamental principle of getting out of debt; it does not only apply to the mortgage but other consumer debt as well. Every single tips and trick that help you pay off mortgage fast will always chase back to this principle. We will cover lots of them in the coming months. Stay tuned.

Email thesmartandlazy@gmail.com or follow me on Twitter @thesmartandlazy if you have any questions.

Pingback: Understand Interest & Principal on Your Mortgage Payment | The Smart and Lazy