This is the second part of my investing for children series. In a previous post, we talked about why should we invest for your kids and what you need to know beforehand. Now, let’s dive into what to invest for your children in New Zealand.

Index Fund & ETF for Kids

In case you don’t know, I am a big fan of the low-cost index fund and ETF because this is a low-cost investment option with a diversified portfolio and low entry requirement. Naturally, I will put my kid’s investment into them as well as a managed fund with ETF and Index fund in it. However, lots of investment services won’t accept anyone who is under 18 years old as investors. Basically, under their terms and conditions, you will have to be 18 years old or over to sign that agreement. Therefore, there are not a lot of choices for children.

Looking for investment options for my kids

Furthermore, a good investment for kids is kind of the hidden gem out there. The one that advertised heavily aren’t very good, and you will have to dig deep to find the good ones. After lots of googling, emailing and reading, here are my top picks.

SuperLife MyFutureFund

Hidden Gem No.1 is Superlife MyFutureFund. This is a different service from SuperLife KiwiSaver and SuperLife Invest (non-KiwiSaver Service). This service doesn’t have a web page at the moment so you won’t find it on SuperLife web site. The information is buried under SuperLife Invest Product Disclosure Statement, page 26 and 27 of that PDF file.

(Superlife is currently redesigning their website. The myfuturefund page will return after that.)

MyFutureFund itself is NOT an index fund or managed fund, it’s just a way that allows children to invest in SuperLife’s product. The account is in the child’s name but the guardian/person opening the account has control of the account including access to the funds through until 18 years of age. The account is separate from parents account, but you would be able to view the account through a “linked” membership.

MyFutureFund has access to the all Superlife investment options. There are over 40 different investment options available for kids including ETF, index fund, sector fund and managed fund. My personal picks for my kids are SuperLife 100 and Overseas Shares (Currency Hedged) Fund.

SuperLife 100 is made up of mostly Vanguard Index fund and ETF plus fund from Somerset. The investment included, 55% of international shares, 33% of Australasian shares and 12% listed property. The management cost is 0.52% and risk indicator at level 4. Three years return after tax (PIR at 28%), and fees are 8.35%. Seven years return is not available.

Overseas Shares (Currency Hedged) Fund is made up of eight Vanguard ETF. Invested 100% in international shares and mainly in US and Europe stock market. The management cost is 0.48% and risk indicator at level 4. Three years return after tax (PIR at 28%), and fees are 7.52%. Seven years return is 11.47%.

I picked those two funds because they are both diversified and contain 100% growth asset. Regarding fees, the management fees are relatively low, and SuperLife’s annual admin fees are only $12/years. They do not have regular contribution requirement, minimum investment amount can be just $1. So Superlife is great for both regular and irregular investing for your kids. I already got an account with SuperLife on my own so linking the kid’s account is straightforward and easy.

What about Investment for Mid-term

Those two fund that I suggested were 100% growth asset, so they are aggressive fund. They provide a great return for long-term investing. However, they will be too risky for mid-term investment. If you plan to use that money within 4-10 years, you may consider some other fund with lower growth asset.

SuperLife 30, 60 and 80 are similar to SuperLife 100 but added a different percentage of income asset. Fund with more income asset will have a lower range of gain and loss in any given year, and better return during recession compare to 100% growth asset fund. On the other hand, when the market is booming, those funds will have a lower return.

I think Superlife 30 will be ideal for 4-6 years investment, Superlife 60 will be great for 6-8 years, and Superlife 80 will be ideal for 8-10 years. For example, if your kid is 12 years old and planning to use that money for the university at 19-year-olds. Your investment timeframe will be 7 years, and you should consider Superlife 60. For any plan under 4 years, term deposit with the bank is a good choice.

How To Join MyFutureFund

SuperLife doesn’t have the easiest way to join so there is how you can join them. You will need to fill in the application form from SuperLife and send it over by mail or email.

- Download and read SuperLife Invest Product Disclosure Statement

- Go to Applications form (page 22 of the PDF file) and fill out your kid’s details and use a separate email set up for kids investing.

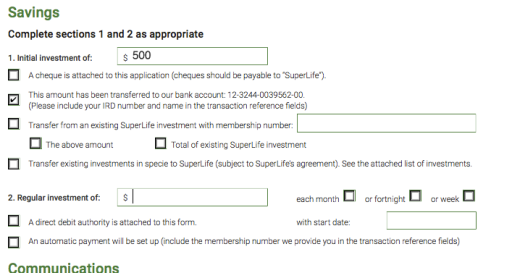

- Under Saving section, you choose how you are going to invest. It can be one lump sum investment, regular investment or both. The example below starts with $500 lump sum investment with NO regular contribution.

- Fill out the Communications and ID verification. You should be using NZ passport or NZ Birth Certificate for the kid.

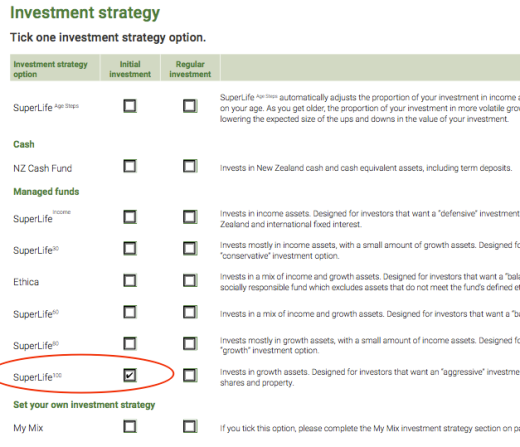

- Under Investment strategy, they will ask if you would pick their managed fund first. If you wish to join SuperLife 100, just tick as below.

- If you wish to join other funds or join multiple funds, you’ll need to tick “My Mix” and go to the next page.

- At page 5 of the application form (page 26 of the PDF file), fill in initial investment or regular investment. You can set the amount by actual dollar value or by percentage. At the example below, I invest 50% to Superlife100 and 50% to Overseas Shares (Currency Hedged Fund).

- On the right side of My Mix page, you can decide what to do with your investment income. They can be reinvested into the fund or save the return in cash fund. Reinvestment is the most common choice for kids. Below that, you can decide rebalancing options, I suggest to use the standard rebalancing for the kids.

- At the next page (page 25 of the PDF file), after you pick the beneficiaries (usually “My estate”), DO NOT sign at the bottom. You should move onto the next page.

- At the next two pages (Page 26 and 27 of the PDF file), you will have to fill in your own information as the guardian, supply the ID information, and sign it.

- Once you completed the application form, you can send it over to SuperLife, and the investment account will be ready in a couple days.

If you have any other questions, contact Superlife with superlife@superlife.co.nz or call them at 0800 27 87 37.

InvestNow’s Vanguard Fund

The second gem is InvestNow. InvestNow is an online investment platform provide multiple investment fund for their investors with low entry require and no middle-man fee. You can check out my blog post on InvestNow here. Unlike other investment services, InvestNow’s term and condition do not have an age restriction. Therefore, InvestNow opens the door are a whole range of investment fund for your kids. You can check out the full range of investment fund from InvestNow here.

Out of all those investment options, my pick for my kids is Vanguard International Shares Select Exclusions Index Fund. That fund launched for AUS and NZ market in late 2016. It contains about 1500 listed companies across 20 developed international markets (without Australia). This fund is an ethical fund as they excluded Tobacco, controversial weapons and nuclear weapons investment.

The BEST things about this fund are the cost. It only charges 0.20%/year on management fees and NO annual admin fee. The fund itself is a wholesale fund, which means it usually only accept institutional invest. The minimum initial investment required was AUD $500,000. The good news is, investors can join this fund via InvestNow with just $250 investment. (InvestNow will lower that requirement to $50 shortly.)

There is two version of this fund, one with NZD currency hedged with 0.26% management fee and one without currency hedged with 0.20% management fee. Without currency hedge, the fund is exposed to the fluctuating values of foreign currencies. So this fund will have a higher risk and lower cost. On the other hand, you will pay a higher fee for a more stable return with the currency hedged fund.

Here is the link to check out those two funds in details.

Vanguard International Shares Select Exclusions Index Fund

Vanguard International Shares Select Exclusions Index Fund – NZD Hedged

Pay Tax on Investment

Those two funds have a different tax treatment compare to common PIE fund. With PIE fund, the investor usually just need to submit their IRD number and PIR rate once, then they don’t need to worry about tax. With those Vanguard funds in InvestNow, they are Australian Unit Trusts and will be taxed under Foreign investment funds (FIF) rule. Investors are required to submit their income from FIF and file a tax return every year. If the holding amount is under NZD $50,000, which should be the case for most children investors, you will need to pay tax on the dividend you received with the kids’ RWT rate. If the holding is over NZD $50,000, you will have to calculate your taxable income with either Fair dividend rate (FDR) method or Comparative value (CV) method.

For children investors with portfolio value under $50,000, filing a tax return on dividend received is not too hard. You will need to file a Personal tax summaries (PTS) with IRD, and it can be done online. I will share how I do that with my kids next year. Regarding FDR and CV method, I personally don’t know how to do it. You better to talk to a tax accountant for that.

How to Join InvestNow

InvestNow sign-up process is very straight forward so there won’t be a step by step guide. You’ll need to click on the join link on InvestNow home page and use a separate email address to sign up. After you sign up an account, InvestNow will ask you to provide information on identification. You don’t have to complete that. Instead, contact them directly with contact form or call them at 0800 499 466 and let them know you want to set up an account for your children. Make sure you got the following information ready

- Email address of the account

- NZ birth certificate or a passport for a child

- IRD number of the child

- PIR and RWT rate for the child

- Proof of guardian’s address

InvestNow will be able to set up an investment account from here. They can also link multiple child accounts to your current InvestNow account if you have one already.

Update on functions

Currently (at 19 Sept 2017), InvestNow don’t have auto-invest function, and the minimum transaction amount is at $250. So it’s not the best choice for someone who wants to regularly invest for their kids because they will have to transfer $250 into InvestNow, then login to their platform and manually invest that money into the fund. The Good news is InvestNow will implement auto-invest function and lower the minimum transaction limited to $50 shortly. So Investors can set up instruction to let InvestNow automatically invest into your preferred fund everytime you transfer money to them.

(Update, InvestNow added auto-invest function with $50/transaction.)

Conclusion

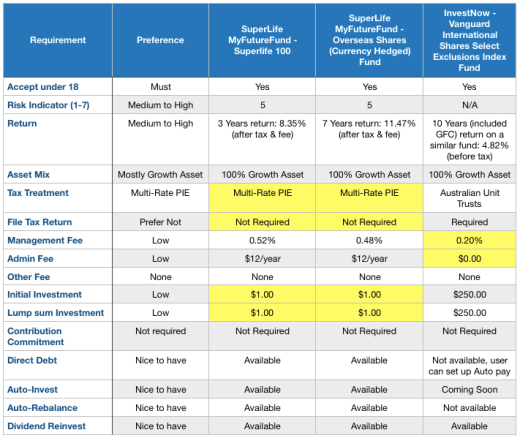

Here is the breakdown of my top picks compare to our kid’s investment requirement.

- Superlife MyFutureFund provides a full range of fund for different investment timeframe. They have all necessary function for you to setup different investment plan for your kids. A great “set and forget” solution. However, they don’t have the lowest fee.

- InvestNow allows user to invest in a great Vanguard investment fund with 0.20% management fee and no annual fee. However, you will have to do a tax return for your kid every year.

- Feel free to contact them before you sign up and understand the process. I found both companies is great with answering customer questions.

In next part of my investing for kids series, we will look at some other investment options including KiwiSaver, Bonus Bond, SmartShares and more. If you are currently invested in or considering some investment program for your kids and want me to cover them, drop me an email at thesmartandlazy@gmail.com. I will try my best to cover that.

Pingback: The Best Way to Invest for Your Children in New Zealand – What You Need to Know | The Smart and Lazy

“The quarterly payment is $625/quarter, so the total cash included in this analysis will be $625 x 4 = $2500. I used BNZ rapid save account as our serious saving account here. (By the way, BNZ Rapid Save is one of the better serious saver accounts out there.) The interest rate is at 2.2% and its allow one withdraw per month without losing the bonus interest.”

I understand from the Rapid Saver that the bonus interest only gets paid if the outgoing amount is less than the ingoing amount for that month, are your calculations based on that? Not the way I read the above?

LikeLike

Hi, I think you posted the comment in another post. Anyway, you are correct on BNZ term and condition. The reult will lower the matching ROI to pay annually

LikeLike

Waiting for investnow to lower the minimum to $50 & allow auto~invest before I create a ‘set & forget’ account for my toddler. Btw thanks so much for your posts, it’s so helpful and easy to understand, especially for New Zealanders~ just hardly any investing info for beginners out there !!

LikeLike

According to InvestNow, auto-invest is only weeks away. Maybe a bit more time for $50 invest.

LikeLike

Pingback: The Best Way to Invest for Your Children in New Zealand – Other Options | The Smart and Lazy

Pingback: The Best Way to Invest for Your Children in New Zealand Part 1 – What You Need to Know – Kiwis pursuing Financial Independence and Retiring Early

Hi there, great article. Seems like auto invest has arrived and I’m about to sign up. Just a question: wouldn’t it be better to sign up in the lower income earning parents’ name, e.g. a stay at home mum? Cheers

LikeLike

Stay home mum may have the same low tax rate as kid, however investing for kids is a 10-15 years investment and I am not too sure if the mother gonna be the stay home mum for that long. On the other hand, we can pretty sure our kids won’t be earning any income from 0 – 15 years old so I prefer put it under their name. Also, if the fund is under their name, they should be more interested to know about investing at young age.

LikeLike