AMP Capital NZ introduce three new low-cost index funds for New Zealand investors. Yay! They are available for AMP’s client and on InvestNow platform.

Three New Index Fund

AMP Capital NZ have been offering investment fund and KiwiSaver fund for New Zealander. Most of their funds are actively managed. So its great to see AMP bring the passive fund to their client. According to Investment News article, AMP Capital NZ managing director Grant Hassell said, “there’s been a lot more demand than we expected from retail investors [for passive options].” It great to see more New Zealand companies on board with the low-cost passive investing movement.

Here is the summary of those new index Fund

NZ Shares Index Fund

Description: Aims to provide a return that closely matches the return of the S&P/NZX 50 Index (on a gross basis and including imputation credits).

Risk Indicator: 4

Management fee: 0.33%

Buy/Sell Spread: 0.10%

Similar Fund/ETF: NZ Top 50 from SmartShares

All Country Global Shares Index Fund

Description: Aims to provide a return that closely matches the return of the MSCI All Country World ex Tobacco Index in New Zealand dollars with net dividends reinvested (69% hedged to the New Zealand dollar).

Risk Indicator: 5

Management fee: 0.38%

Buy/Sell Spread: 0.15%

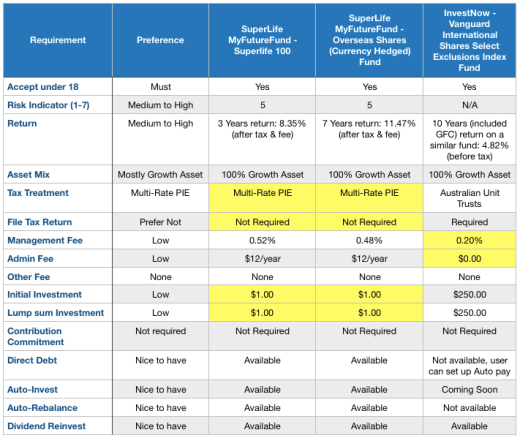

Similar Fund/ETF: Vanguard International Shares Select Exclusions Index Fund (Hedged) – NZD Class on InvestNow

Hedged Global Fixed Interest Index Fund

Description: Aims to provide a return that closely matches the return of the Bloomberg Barclays Global Aggregate Index, fully hedged to the New Zealand dollar.

Risk Indicator: 3

Management fee: 0.39%

Buy/Sell Spread: 0.10%

They are structured PIE funds, do not have annual admin fee, and minimum investment amount is $50.

Unlike some fund manager which charge active management level fees on their passive investment options, those index fund options from AMP Captial are actually cheap in New Zealand standard. Kudos to AMP!

Well Done AMP!

Buy and Sell Spread

You may notice apart from the usual management fee; there is a Buy/Sell Spread for the fund. All AMP fund have Buy/sell spread, and they are your entry and exit fee.

For example, if you decided to put $10,000 into All Country Global Shares Index Fund, 0.15% of $10,000 will be taken out as buying cost. So only 10000 – (10000 x 0.15%) = $9,985 will be in the fund.

Three years later, your investment in that fund grow to $12,000, and you want to cash out. When you cash out your investment, 0.15% of $12,000 will be taken out as selling cost, and you will end up with $11,982.

When you buy and sell shares, there will be a transaction cost. ASB and ANZ charge a retail customer $30 or 0.30% for each transaction. The fund manager also needs to pay for buying and selling shares for their fund.

You may not see Superlife and Simplicity charging a separate buy/sell spread, but it doesn’t mean they don’t have to pay a transaction cost. They decided to include those costs into the management fee and make it simple for investors.

Usually, I’ll prefer simple fees structure because in some cases, a fund manager will list multiple fee item to confuse the customer and charge more fees. However, I do believe having a buy/sell cost will benefit long-term investor like me.

First, buy/sell cost separated from management cost means the management cost can be reduced to a lower level (it’s no guaranteed fee will be lowered. Some other fund just use that as an excuse to charge more fees). Second, as a long-term investor, I will only buy a small amount every month, so buy/sell spread won’t reduce my return much. Finally, for those who think they can time the market and try to get in and out a lot, they will pay for their transaction. I am happy to know my money are sitting nicely in the fund. The cost of the transaction from other investors won’t eats into my return.

Therefore, having a Buy/Sell Spread will be good for the investor as long as it reduces the overall cost for investors. On the other hand, it does make it harder for investors to compare the cost. Don’t worry; I’ve done the hard work for you.

SmartShare Vs AMP Capital

AMP Captial NZ Shares Index Fund will track S&P/NZX 50 Index, which is designed to measure the performance of the 50 largest, eligible stocks listed on New Zealand stock market main board. SmartShares NZ top 50 ETF is tracking a very similar index, the S&P/NZX 50 Portfolio Index, which also measures the performance of the top 50 companies in New Zealand stock market main board. However, there is a 5% cap on the individual stock, that is more aligned with what a retail investor may hold.

S&P/NZX 50 Index returns are: 3 Years – 9.79%, 5 Years – 10.99% and 10 Years – 2.51%.

S&P/NZX 50 Portfolio Index returns are: 3 Years – 10.15%, 5 Years – 11.72% and 10 Years – 3.31%.

SmartShares NZ top 50 ETF will charge 0.5% management fee. If you are in the SmartShares saving plan, there will be a one-off set up fees for $30. If you invested in Superlife NZ top 50 ETF Fund, the management fee would be 0.49%, no setup cost but there will be a $12/admin fees. On my previous post, we calculated SmartShares would be cheaper if the value of your fund is under $120k. Earlier this year, InvestNow added SmartShares NZ Top 50 ETF fund on their platform. InvestNow customer can bypass the $30 set up fee which made InvestNow be the best options for NZ top 50 Index fund.

Now AMP Captial NZ Shares index fund offer no setup fees, no admin fee, and management fee at 0.33%. There will be a buy and sell spread for 0.1%.

10-Years Analysis

Since the costing structure of SmartShares and AMP’s is a bit different, I decided to run a 10-years analysis for both options to see which fund will pay less on fees and provide a better return for the investors.

I will be using NZX Gross return from 2004 and 2014 as my return data. It has a right mix of bull market (04-07), recession (07-10) and recovery (10-14). The tax will be ignored in this analysis.

We will compare an investor putting $50/month in each fund for ten years and will cash out all investment at the end. For SmartShares NZ Top 50, we will use InvestNow platform as this is the most cost-efficient way.

Here is the result for SmartShares NZ top 50 ETF via InvestNow

Here is the result for AMP NZ Shares Index Fund.

SmartShares balance was higher at the beginning as there was 0.10% buy spread charged on AMP investor. However, since AMP charge less on management fee, the money stays in the fund generated a better return. In the end, AMP NZ Shares Index Fund valued at $8,481.82 and SmartShare NZ Top 50 ETF valued at $8,423.70. AMP total fee paid is $124.95 (1.47%) compare to SmartShares at $166.55 (1.98%).

Therefore, for long-term investing, AMP NZ Shares Index Fund came out ahead by a small margin, 0.69% at the 10th year mark. Since there is no fixed-dollar fee, this result will be the same if you invest $50 or $500/month. AMP investor will have a better return from year 3 and onwards.

What Not to DO

In some situation, AMP will cost you more. Since AMP charge 0.10% on Buying and selling, if you move your money in and out a lot, it will cost you a lot of fees.

The simple way to understand is to imagine you move some money into the fund, got charge 0.10% on buy spread; you keep the money in for one year, got charged 0.33% management fee; you move it out at the end of the year, got charge 0.1% sell spread. So in that year, you’ve got charged 0.10% + 0.33% + 0.10% = 0.53%. So it charged more than SmartShares ETF.

If you keep putting money in and stay in the fund, the money in the fund will charge a lower management fee. Lower management fee means more money is remaining in the fund and it should provide a better return for you. Therefore, to optimise your return, you should avoid moving your money around and stays in the fund.

Tax on Investors

Those three funds are PIE funds. Investors with PIR lower than 28% will benefit from AMP fund because SmartShares ETF is listed-PIE fund. You will be tax at 28% regardless of your PIR with SmartShares. Check out my previous post on Listed-PIE vs multiple rated PIE fund and work out your PIR here.

Should You Switch?

The margin of difference is not that big, we are talking about 0.69% after 10 years, so it’s not a “drop everything and switch NOW” situation. However, if you are aiming to optimise your return, AMP should be the better choice. If you are on lower PIR, or you still don’t like SmartShares’ improved user interface, switch over to AMP.

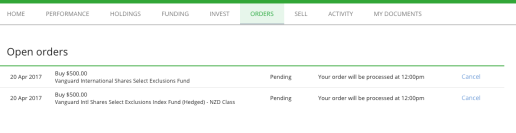

Personally, I think I will invest in this AMP fund via InvestNow. Since I already have an account with InvestNow, I can quickly put some money in without signing up with AMP.

Conclusion

- Three New index fund from AMP Capital NZ

- No annual fee for all funds, lower management fees, the investor will be paying buy/sell spread, minimum investment from $50, structured as PIE fund.

- NZ Shares Index Fund – is the cheaper version of NZ Top 50 ETF, management fee at 0.33%, Buy/Sell spread 0.10%

- All Country Global Shares Index Fund – is the more expensive version of Vanguard fund in InvestNow but as structured as PIE fund (no tax return required), management fee at 0.38%, Buy/Sell spread 0.15%

- Hedged Global Fixed Interest Index Fund – managed fee at 0.39%, Buy/Sell spread 0.10%

- Buy/Sell spread is buying and selling cost for the investor. In this case, its benefit long-term, buy and hold investor.

- NZ Shares Index Fund will be cheaper than SmartShare NZ Top 50 ETF if you hold it for long-term

- It will cost you a lot of fees if you try to time the market and move your money in and out a lot.

- All three funds are available from AMP Captial NZ and on InvestNow platform

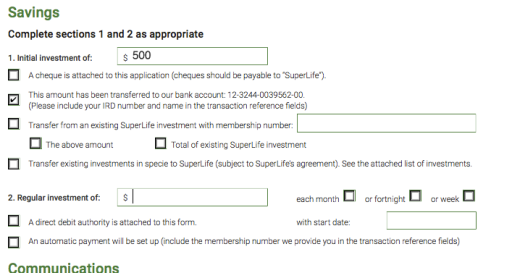

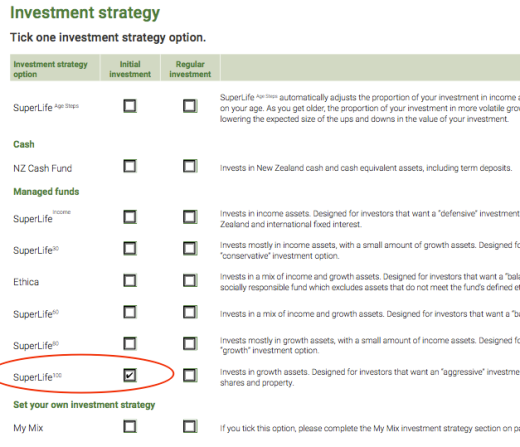

You decide how much you want to invest and how frequently. You can invest on a weekly, monthly, quarterly or six-monthly basis. Also, you can choose when the plan start and end. Below is an example for $100 invested monthly with no end date.

You decide how much you want to invest and how frequently. You can invest on a weekly, monthly, quarterly or six-monthly basis. Also, you can choose when the plan start and end. Below is an example for $100 invested monthly with no end date.