Range of Fund

No Transaction/Admin/Joining/Setup/Exit Fee

The REAL selling point

Vanguard fund

SmartShares offer 23 exchange-traded fund (ETF) in New Zealand. They tracked different stock and industry index in New Zealand, Australia, United States and international market. It is an excellent opinion for Kiwis investor due to the low-cost and diversified portfolio. So, how easy to get your money out? (Spoiler alert: Very easy)

ETF is similar to an index fund that tracks an index, a commodity, bonds, a sector or a basket of assets. However, ETF can be traded on the stock market like any other stock. ETF shareholders are entitled to a proportion of the profits, such as earned interest and dividends paid.

Since ETF is a share, i. In order to get the money out, you will have to sell your ETF in the stock market, just like any other stocks. This brings us to Liquidity of a share.

Liquidity means how easy for you to sell your share into cash on the stock market. If lots of people wanting to buy that share and lots of willing seller on the market, the liquidity is good.

We use trade me as an example here. If you are selling a brand new iPhone on trade me at a price closed to everyone else is selling, you will be able to sell that iPhone quickly. Also, you can use similar amount cash to buy an iPhone on trade me without any problem. So the liquidity of an iPhone is good on trade me.

However, if you want to sell an expensive and rare antique phone on trade me, it may take months and multiple listing to sell that phone. You may have to lower your price to get it sold. It also hard to find another expensive and rare antique phone on trade. So, the liquidity of an expensive and rare antique phone is bad.

Let’s take a look at Auckland International Airport’s stock info.

You can see there is lots of buying (Bids) and selling (Asks) order. Lots of trade happened in 13 mins. The different between buy and sell price (a.k.a. Bid-Ask Spread) is only $0.5c.

Now compare that to Delegat Group Limited’s Share.

There are some buy and sell order, but there was no trade at all. The different between buy and sell price is $10c. There is a seller want to sell 2000 units of share at $6.25, but there is no one taking that offer. If the owner of that 2000 share intends to liquidate the stock quickly, they will have to lower their selling price by $10c to $6.15 to meet the closest bid. That is $200 less on 2000 share.

I always encourage people to start a small investment with NZ Top 50 ETF and US 500 ETF when they are starting out. Those two ETFs are easy to understand, diversified, low-cost and have low minimum investment requirement ($500). They are ideal for long term (7 years+) investment. So here is the cheapest way to buy and hold NZ Top 50 ETF.

I will be discussing average investment here. I do not include KiwiSaver opinion here because you can’t get the money out before 65. (Anyway, ETF still an excellence option for KiwiSaver, especially for anyone aged under 50)

Quote from Smart Shares Web Site:

The NZ Top 50 Fund invests in financial products listed on the NZX Main Board and is designed to track the return on the S&P/NZX 50 Portfolio Index. The S&P/NZX 50 Portfolio Index is made up of 50 of the largest financial products listed on the NZX Main Board. The S&P/NZX 50 Portfolio Index is made up of the same financial products as the S&P/NZX 50 Index, but with a 5% cap on the weight of each product.

So basically when you invest in NZ Top 50, you will have a share in the top 50 companies in NZ stock market.

Stock code for NZ Top 50 ETF is FNZ.NZ

There are three ways to purchase NZ Top 50 ETF, on the stock market, with investment fund or monthly contribution.

Trade on the stock exchange – NZ Top 50 ETF can be traded as share on stock market via any stock broker. I will be using ANZ Securities online and ASB securities online here as they are amongst the cheapest brokers in New Zealand.

Purchase with Fund – Superlife (Smartshare’s sister company) offer NZ Top 50 ETF fund that holds shares in NZ Top 50 ETF. You can set up an account and purchase those fund with Superlife.

Purchase via monthly contribution – This is the most accessible and fixable way to buy into ETF, both Superlife and Smartshare offer that service. You need set up an account with at least $500 initial investment, and contribution $50 monthly to purchase that ETF or fund.

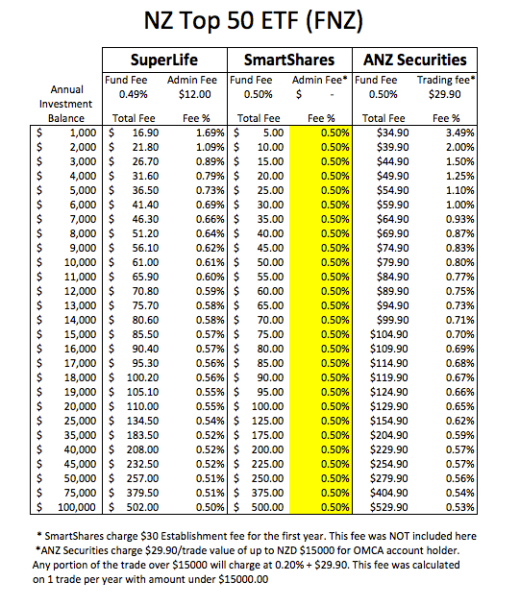

Basically, you should look for the lowest fee when you consider investing into the same product.

ANZ & ASB Securities online: You can purchase FNZ directly on the stock market with ANZ Securities. ANZ cheapest rate is $29.90/trade under $15000. However, you have to be an Online Multi-Currency Account (OMCA) holders with sufficient cleared funds available to fully cover the purchase of securities prior to submission of the order. Otherwise, ANZ charge $29.90 + 0.40% on trade. If you are not an OMCA holder with ANZ, go with ASB Securities, they charge $30 or 0.30% per transactions, whichever higher. On top of that, NZ 50 ETF charge 0.50% p.a. on management fee base on your total holding before they pay out. If you did the calculation, in order to pay the least amount of fees, you should only make one trade a year with over $10000, which will bring the fee% to 0.80%.

Smartshares: You can make lump sum investment and monthly contribution with smartshare. They will charge a one-time $30 account setup fee and charge 0.50% p.a. management fee base on your total holding. Check out the SmartShares disclosure statement here.

Superlife: Same as Smartshare, you can do lump sum investment and monthly contribution. They charge a $12 p.a. administration fee and 0.49% management for NZ 50 Top ETF. Check out Superlife disclosure statement here.

Smartshares is the cheapest way to buy and hold FNZ. Superlife’s fee will become cheaper once the holding passed 120K.

I personally used both Smartshares and Superlife, and I think Superlife have a much better user interface and app. The $12 admin fee can be shared with other Superlife funds.

So if you just want to buy FNZ, Smartshare is the best deal out there. If you already have other funds with Superlife, there is not much difference in cost between Superlife and SmartShares.

Although ASB and ANZ Securities’ cost are higher, you should open an account with them if you got ETF from SmartShares. Since you are buying actually share of ETF via Smartshare, you will need a stock broker when you need to sell your share.

Email thesmartandlazy@gmail.com or follow me on Twitter @thesmartandlazy if you have any questions.

At the last post, I made a simple graph to explain where to invest your money. Now let’s break it down in more detail

For such a short terms, your best bet will be keeping your money in a savings account. Most banks offer serious saver or notice saver accounts with interest around 2.25 – 2.75%. I know it’s not a good return but its better than nothing. You may also consider a 6 months to 1-year term deposit for higher interest (3 – 3.5%). However, if you need to get your money out early, you may lose the interest and pay a break fee.

Recommended products: ASB Saver Plus, ANZ Serious Saver, BNZ Rapid Save, Westpac Online Bonus Saver, Kiwi Bank Notice Saver, RaboDirect Premium Saver and Notice Saver.

You still want to play it safe so you should keep the money in cash. In this time frame, you can use a term deposit as they have a higher return of interest, around 3.5 – 4%. As mentioned previously, watch out of the penalties for early termination.

Recommended products: Term Deposit for all major bank.

If your money can stay in the market for 3-5 years, income assets become a feasible opinion. BBonds are not as stable as term deposit return, but they do offer the potential to earn a higher yield. I would suggest investing in a Bond ETF or a Bond Fund over buying individual bonds via a stock broker for small investors due to the cost of trade. Bond ETFs and Funds invested in multiple corporate and government bonds, which should reduce the risk

If you are willing to dip your toes in the share market, you can buy some dividend shares at this stage. Dividend shares are usually associated with established and mature companies on the board that pays out dividends constantly. Don’t expect those companies to have rapid growth but they usually pay out dividends every quarter. The volatility of those shares is smaller compared to other shares on the market. Spark, Auckland Airport, and power companies are considered dividend stock in New Zealand.

Recommended products: NZ Bond ETF, NZ Dividend ETF, NZ Bonds Fund, Global bonds ETF, Overseas Bonds Fund.

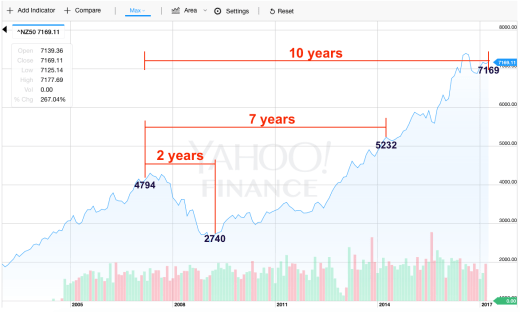

At this stage, growth assets will play an important part in your investments. Growth assets are shares, properties, and managed funds. The reason we shouldn’t touch growth assets until this stage is because of the volatility of the return. Year-to-year return can be ranged from -80% to +80% , but over longer periods it usually goes up. Take a look at the graph below. It shows the NZ stock market’s return in 2 years from April 2007 to April 2009.

If you invested in the stock market in April 2007 and planned to exit the market in April 2009, you would have lost about 35% of your investment.

On the other hand, if you had stayed in the market for 7 years, you would have gained 24% on your investment.

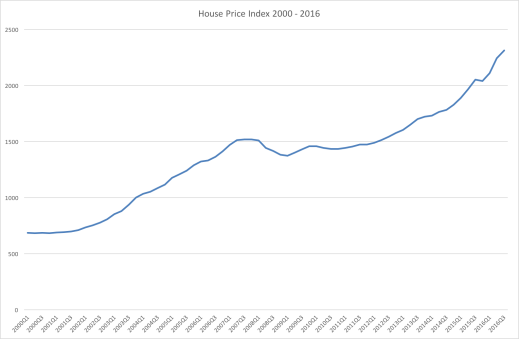

The same principle applies to property investment. The House Price index from 2000 to 2016 shows New Zealand property prices are trending up in the long term. You can see there was a dip during the 2008 GFC and the price recovered within a few years.

Therefore, in this timeframe, you should invest more and more into growth assets and the ratio of Bond and Dividend stocks should decrease.

Recommended product

30-80% of Growth Asset: NZ Top 50 ETF, S&P 500 ETF, Total World ETF, Property Fund, Oversea Shares Fund, Australian Shares Fund.

70-20% of Bond and Dividend shares.

At this point, I recommend invest 90% of your investments in growth assets and expect a long-term positive return on share and property. You may wonder why the income asset portion goes down to 10%. Although income assets are considered a safer investment, but they cannot match the high return of growth assets. Having a small amount of income assets in your investment will help offset potential downturns in your growth assets. Income assets don’t crash like growth asset, it will act as a cushion to soften any drops in the market.

Some people think if you are young and you can handle a market crash, you should have 100% growth assets as your investment. Whilst I agree with this point of view, it basically comes down to risk tolerance and personal preference.

Recommended product

90-100% of Growth Asset: NZ Top 50 ETF, S&P 500 ETF, Total World ETF, Property Fund, Oversea Shares Fund, Australian Shares Fund.

10-0% of Bond and Dividend shares.

So this is the guide that I used to decide where to invest my money based on how long I was going to invest. In the next post, I will talk about risk tolerance adjustment and how KiwiSaver funds fit into this graph.

The timeline and investment ratio used in the graph are based on my own studies and conventional wisdom. Investment suggestions are based on neutral risk tolerance. Investment products listed are based on popularity, ease of access in New Zealand and a bit of personal preference.

Just a reminder, this graph is for GENERAL ADVICE ONLY. Your own situation may be different. Please thoroughly research everything you read here and seek professional advice if you need to.

Email thesmartandlazy@gmail.com or follow me on Twitter @thesmartandlazy if you have any questions.

In this blog post I listed 10 mistakes that I made as a First home buyer. Now, here are more details about what I’ve done wrong.

So, those were my rookie mistakes when I first started my mortgage. Hope you guys won’t make the same mistakes that I made. Now, my mortgage set up is optimal for my situation and I will write about it in a coming blog post.

Email thesmartandlazy@gmail.com or follow me on Twitter @thesmartandlazy if you have any questions.

The No. 1 personal finance question being asked online is “I have $XXX in saving, where should I put it?” or “What should I do with my term deposit?”. People who are unfamiliar with personal finance usually have no idea where to investment their money except term deposit and property (Oh, the old Kiwi dream). While property seems out of reach and interest rate on term deposit are hitting all time low, Kiwis are looking for another way to invest for their future.

You should put your money to invest after you pay off your consumer/personal debt, join KiwiSaver, and have an emergency fund. I believe you are not in the position of investing if you still haven’t got your financial basic sorted out.

The first thing you’ll need to work out is How long can you leave the money in the investment? or how long before you will need to use that money?

If you are saving for a new car in 3 years, then 3 years is your answer. If you are saving for retirement and you are 30, 10+ years will be your answer.

Make sure you have money set aside for emergency before you invest. You don’t want to be in a situation where you plan to invest in the stock market for 8 years, some emergency happen in year 2 and you are forced to sell your investment at a loss.

Once you’ve worked out the time, apply that to the graph below.

Let’s say if you plan to invest for 6 years, according to the graph, you may want to consider invest 60% of that money into growth assets such as stock, property, ETF, and index fund, while the other 40% investment into Bond or Dividend stocks.

If you invest for your retirement in 20 years, you may want to have a portfolio with 5-10% bond and the rest with stock.

On the other hand, if you wish to use the money to buy a car in 2 years. It’s best to put it in a term deposit.

You may have multiple plans for your money, such as $3000 for travel next year, $12000 for a new car in 30 months, and $20000 for the first home in 8 years.

You need to apply those plan individually to the graph.

$3000 travel fund in saving account

$12000 car fund in term deposit

$20000 in a 10:90 mix portfolio while you keep adding more into the investment every month.

I will explain the basic idea of this graph, the mix of investment in this post and how to apply risk tolerance in the next post.

The timeline and investment ratio on the graph are based on my own study and conventional wisdom. Investment suggestion is based on neutral risk tolerance. Investment product listed on the graph are based on popularity, ease of access in New Zealand and a bit of personal preference.

Just a reminder, this graph is for GENERAL ADVISE ONLY. Your own situation may be different. Please thoroughly research everything you read here and seek professional advice if you need to.

Email thesmartandlazy@gmail.com or follow me on Twitter @thesmartandlazy if you have any questions.

I was sorting my paperwork and saw my old mortgage paper. I was such a noob back then and made a lot of mistakes when I set up that mortgage.

When I and my wife start hunting for house couple years back, we’ve done the first timer mistake by walking into my friendly local bank which I’ve been banking with for 10+ years, ask about home mortgage and got introduced to a personal banker. Had a 30 mins meeting where the banker took our account statement and worked out our income, expense, and deposit. We walk away with a 600K loan pre-approval.

So, we went on to house-hunting and luckily got a house at auction (passed-in then negotiate). We took the purchase agreement to went to the bank again. This time stayed there for an hour. Got a 500K fixed 2-year at the advertised rate home loan, pay monthly plus a life insurance for both of us, house and content insurance. I was so proud of myself because I also got a $1000 cash back and used that to pay the lawyer. The mortgage payment was about $2400/month plus $180 for the insurance. I remember when I walk out of that bank I felt a sense of accomplishment. I knocked down home ownership, mortgage, life, content, and house insurance on the same day.

Now I look back at the mortgage statement, I was such a NOOB!!!! I’ve made so many first timer mistakes!!!

The ONLY thing we did right was the downpayment. At that time, you can get a home mortgage with just 5% deposit and lots of people did that. We decided to put over 20% as deposit since we saved up some money already.

At that time we didn’t know much about mortgage….actually, we don’t know much about money, personal finance, saving and spending at all. We were stuck with this deal for 2 years and within that time, we had a money crisis that forced me to educate myself about money. I read books from the library, research online, builds home loan model in excel and ran a bunch of analysis. Now I have a nice setup on a home mortgage with every dollar working to reduced the interest expense.

I am interested to know any of you made those mistake when you first took on a mortgage?

Also if you don’t know what I’ve done wrong or you actually doing the same thing, check out this blog post and I will explain what I’ve done wrong.

Email thesmartandlazy@gmail.com or follow me on Twitter @thesmartandlazy if you have any questions.

as [I wrote this back in 5th Oct 2016]

I’ve got into a discussion with a colleague about changing KiwiSaver plan. He is in his 30s and he decided to switch his growth plan to a defensive scheme. His reasoning was that he thinks there is a market correction coming in late 2016 or the first half of 2017, so by switching to the defensive scheme, he can avoid a drop in his investment. He will switch back to growth once we are out of the correction.

I do agree there is a market correction coming and a defensive scheme will do better in a down market compared to a growth plan.

Let’s use Superlife income (defensive scheme) and Superlife60 (growth) as an example.

During the 2008 GFC, most markets were down by A LOT. SuperLife income returned about 6% to 8% during 2008-2009 and SuperLife60 was returning -8% to -14% at the same time. So if you start your Kiwisaver in 07 in SuperLife 60 (returning 4.8%), then switch to SuperLife Income at 08, 09 (6% and 8%), and finally switch back to SuperLife 60 at 2010 (15%). You would have returned on average 8.45% p.a. while SuperLife 60 was returning -0.55% in those four years.

By looking at the math, it’s all great, but the main question is HOW DO YOU KNOW WHEN TO SWITCH? We are trying to time the market. The return looks great when we do it retrospectively, but in reality, it takes lots of time, resource and knowledge to time the market and people who are experts in that area still don’t get it right. If we switch too early, we may miss out on the last bit of gain. On the other hand, if we change too late, we will take the hit of the initial crash.

I am personally not sure about this. I was trying to time the market back in 2014, and I was wrong. The conventional wisdom was to ignore the ups and downs of the market and keep your investment in a growth fund. You will ride it out eventually. However, somewhere in my mind I still think I can get a better return by switching. Not to a defensive scheme but a balanced scheme to smooth it out.

[Now, back to March 2017]

I ended up keeping the growth fund and it turned out great. The return on those months is far better than the defensive fund. The main reason was due to the poor performance of income asset in the last quarter of 2016.

However, this post is not about growth fund doing better than the defensive fund during that time period. In fact, I’d still be happy if the defensive fund did better because the performance for my KiwiSaver in a single quarter only has a tiny impact on the lifetime of my fund. The lesson I learned was to stick to right fund for me, just sit back and let it grow.

Email thesmartandlazy@gmail.com or follow me on Twitter @thesmartandlazy if you have any questions.

(The information in this post is not longer up-to-date. Please check the most recent update here)

In case you don’t know, I am in the camp of passive low-cost investing. So most of my investment are in ETF and index fund.

Currently, the easiest way to buy and hold ETF in New Zealand is with SmartShares and SuperLife. Both companies are owned by NZX and they are selling basically the same ETF product. However, the cost of the ETF are different with those 2 companies and I’ve put together a table to compare them.

In general, SuperLife offers lower fund management fees. However, they do charge a $12/year admin fee which makes SuperLife more expensive when you are starting out. You should, therefore, start with SmartShares and once your hold reaches the “When to Switch” amount, you can move your fund to SuperLife to enjoy the lower cost and the better user interface.

My table is based on the assumption that you have only 1 fund in SuperLife. If you have multiple funds with SuperLife, that $12 admin fee will be shared by those funds and you can divide the “Switch to SuperLife” amount by the numbers of funds you’ve got.

Here is an example:

You are holding $15000 Global Bond ETF and $12000 Aust Property ETF with SmartSshares. Both of them alone did not pass the “When to Switch” limit. However, if you switch both of them to SuperLife, the “When to Switch” will be divided by the numbers of funds, which is 2, and the new “When to Switch” amount will be $24000/2 = $12000. You should, therefore, switch both of them over to save fees.

Email thesmartandlazy@gmail.com or follow me on Twitter @thesmartandlazy if you have any questions.