Got a couple fund updates in October 2017 including regular investing with InvestNow, cheaper SmartShares management cost, more fund options in Sharesies and new fund with Simplicity.

Regular Investing with InvestNow

InvestNow just rollout their regular investing options. Yay! Before that, every time investors transfer money to InvestNow, the money will be sitting in their “Transaction account”. The investor was required to log into their account and manually invest that money into funds. Not very robust.

Now with regular investing, you just need to instruct InvestNow how you want your fund distributed once and they will do it automatically. Also, with regular investing, the minimum transaction amount is lowered to $50. Here is how it works.

Once you login to InvestNow, you will see a new option called “My Plan”.

Click create to start a new plan.

You decide how much you want to invest and how frequently. You can invest on a weekly, monthly, quarterly or six-monthly basis. Also, you can choose when the plan start and end. Below is an example for $100 invested monthly with no end date.

You decide how much you want to invest and how frequently. You can invest on a weekly, monthly, quarterly or six-monthly basis. Also, you can choose when the plan start and end. Below is an example for $100 invested monthly with no end date.

Next is to instruct which fund you would like to invest by percentage. The minimum investment amount for a single fund is $50/transaction. If you are investing $100, you can invest in 2 different funds at $50/each or $100 in a single fund. Below is an example for $100 invested into two Vanguard funds.

After that, click save and you are done. Make sure you set up an automatic payment from your bank!

I am glad InvestNow introduces regular investing options and lower the transaction amount to $50. It makes it easier for investors to set up automatic payment and use the dollar-cost averaging method to invest. It further lowers the barrier of entry and makes InvestNow be a “set and forget” investment solutions.

Check out their Regular Investment Plan page for more info.

Just be aware that minimum lump sum investment amount is still at $250/transaction.

InvestNow buy RaboDirect’s managed funds line

InvestNow just announced they acquired the Managed Funds product line of RaboDirect. RaboDirect started a marketplace for investment funds in 2006. In fact, the InvestNow’s managing director, Mike Heath, set up RaboDirect’s platform back then.

Now InvestNow acquired the Managed Funds product line from RaboDirect, their customer will transit to InvestNow platform.

I think it’s great as RaboDirect customer get to stay in the same fund and will save more on fees because InvestNow does not charge admin or transaction fee. It will also expand InvestNow customer based. I hope it will lead InvestNow to bring more high quality and low-cost index fund to New Zealand like Vanguard and Blackrock.

Check out my blog on InvestNow here.

Investnow – Invest in Vanguard Fund with 0.20% Fee

Smartshares reduces fee on award-winning ETF

SmartShares’ NZ Mid Cap ETF recently won the New Zealand Equity Sector Fund of the year at the 2017 FundSource Awards.

The NZ Mid Cap ETF tracks the share price of 38 New Zealand Stock and its median market cap at 1,090 million. The index is made up of top 50 companies in NZ stock exchange but excluded the top 10 companies and product issued by non-New Zealand issuers. You can find the stock of The A2 Milk Company, Xero, Air New Zealand, Mercury, Mainfreight and Port of Tauranga in this ETF.

Here is the sector breakdown on Mid Cap ETF.

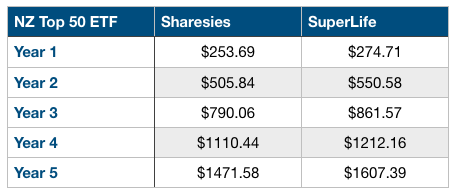

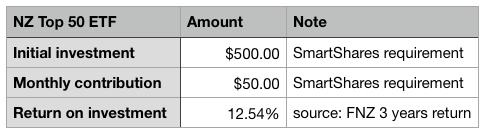

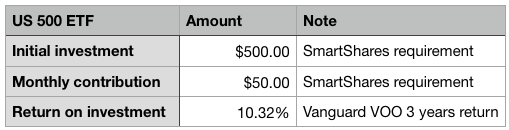

SmartShares just lower their management fee from 0.75% to 0.60%. So this is good news for their current investors. This ETF used to have the biggest cost difference with their ETF fund counterpart in SuperLife. Now the cost is more in line with SuperLife ETF fund. However, SuperLife still has the lower management cost at 0.49%.

Check out my comparison on management fee between SmartShares and SuperLife.

Sharesies added New Socially Responsible Funds

Sharesies, the new Wellington start-up, just added two socially responsible funds from Pathfinder Asset Management. They are The Pathfinder Global Responsibility Fund and the Pathfinder Global Water Fund.

Socially responsible investing also known as sustainable, socially conscious, “green” or ethical investing, is any investment strategy which seeks to consider both financial return and social good to bring about a social change. Those funds will invest in companies practices that promote environmental stewardship, consumer protection, human rights, and diversity. They avoid business involved in armaments, gambling, tobacco, thermal coal and pornography.

Pathfinder Asset Management said Environmental, Social and Governance (ESG) scores as one of the factors to invest with those two funds. Pathfinder Global Responsibility Fund targets 250 stocks from around the world and Pathfinder Global Water Fund target on 50 to 100 companies that generate significant income from water-related activities. Both funds are actively managed, and the management cost is 0.93% and 1.3% per year. Also, those two funds have a transaction fee on buy and sell of 0.05%. So if you invested $50 in either fund, $0.025 would be charged as a transaction fee.

I think Sharesies did a great job adding socially responsible funds on their platform as the fund will appeal to their core customers. However be aware of those two funds are actively managed, and there is a transaction fee on buy and sell.

Check out the fund info here. The Pathfinder Global Responsibility Fund and the Pathfinder Global Water Fund.

One More Thing

One last thing, Simplicity added Guaranteed income fund and I’ve got a sperate blog on that.