I spent a lot of time on my blog talking about ETF and index fund investing in New Zealand. I believe they are great options and an import investment vehicle to help me achieve financial freedom.

However, there are three investment options are objectively better than ETF and Index fund with low entry requirement, low risk and high (sometimes guarantee) return. They are the low hanging fruit of personal finance that everyone should do it. Those three investments options are pay off consumer debt, join KiwiSaver and reduce the mortgage. I will go through each one of them and talk about they risk and return.

No.1 Pay off Consumer Debt

You want to kill those consumer bills ASAP!

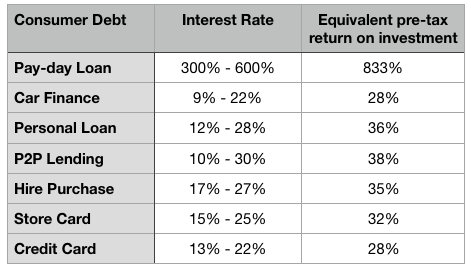

Credit card debt, car loan, payday loan, personal loan, hire purchase, P2P loan… All of those are consumer debt. Debts that are owed as a result of purchasing goods or services that are consumable and do not appreciate in value. Those debts usually have high-interest rate and exorbitant admin fee. If you are paying interest on depreciating assets, they are dragging back you financially. You won’t go forward if most of your income goes to those stupid bills. You need to get rid of them ASAP!

Paying off debt is Investing

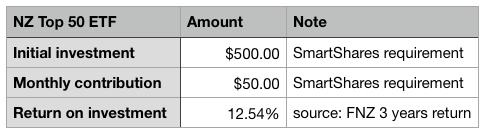

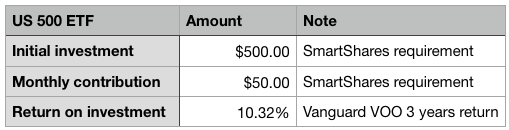

This concept may not be obvious to everyone but PAYING OFF DEBT IS INVESTING. For me, debt and investing are just two sides of the same coin. One side (investing) is to increase your wealth (with a given level of risk). Like you buy NZ Top 50 ETF from SmartShares, if the share price increase and they pay out a dividend, your wealth increased. On the other hand, the shares price may drop, and your wealth will decrease. So there is a risk of losing money with investing.

The other side of the coin (debt) will reduce your wealth. If you have $1000 credit card debt with 20% interest, your interest expense for the first month will $16.67. So your wealth reduced by -$16.67. Unlike investing, the debt will guarantee to reduce your wealth and drag you back financially. Therefore, reduce your debt will move you forward financially, guaranteed.

Whats the return and risk?

I will use a simplified sample to present the financial effect of paying off debt.

Assume you have $1000 in cash and $1000 credit card debt with 20% interest. If you keep the $1000 in cash and don’t pay it off credit card debt, in one year, you will be $1000 x (1 + 20%) = $1200 in debt. Financially you moved backwards by $200.

Now, you invest the $1000 cash in a 12 months term deposit with 3.25%. You still keep your $1000 credit card debt and not paying that off. In one year, your earn $1000 x 3.25% = $32.5 in interest from your term deposit. Take away $9.75 as tax; you will have $1022.75 in cash. On the other hand, your credit card debt still cost you $200 in interest. So financially, you moved backwards by $177.25.

Instead of invest that $1000 into a term deposit, you use that $1000 to pay off your credit card debt. Since the credit card debt is gone, it won’t occur interest. In one year, you will be in the same financial position.

Look at all three scenarios, pay off credit card debt resulted in the best financial position. As you putting that $1000 cash to pay off your credit card debt, you are in fact getting 20% return on those $1000. Unlike other investment, those returns are Tax-free and guaranteed. If you need to get 20% after-tax return on investment, the pre-tax return will need to be 27.77%. That is an excellent return on investment. I am not saying you can’t get 27.77% return out there, but I am sure there is no investment (except KiwiSaver) can guarantee a 27.77% with no risk.

If we look that those high-interest-rate consumer debts, paying them off will be a great return for your money. Also, paying off consumer debt will reduce your financial risk and stress. You will be in a much better position when you negotiated mortgage term and resulted in better deals. That why paying off consumer debt is one of the top three investment options.

What about Student Loan?

The student loan in New Zealand is interest-free as long as you are staying in the country. The payment only occurs when you have income. So you should just pay it off as you’ve got income. I would not be paying them off early unless you plan to leave the country for a long time.

No. 2 – Join KiwiSaver

KiwiSaver is a voluntary, work-based savings initiative to help you with your long-term saving for retirement. It’s designed to be hassle-free, so it’s easy to maintain a regular savings pattern. Once you join KiwiSaver, at least 3% of your income will invest into a KiwiSaver fund. You can only access those fund until you use it to buy your first home or turn 65. What makes KiwiSaver to be a top investment option is because of employer contribution and member tax credit.

Employer match

If you’re over 18 and is a member of KiwiSaver, when you make your KiwiSaver contribution, your employer also has to put money in. By law, the employer required to contribute at least 3% of your income. The employee can choose to contribute either 3%, 4% or 8% but employer only requires to match at 3%. Some employer may decide to match 4% or 8%.

It may seem you will be making 100% return on investment on your 3% contribution. However, IRD will take out tax from you employer contribution, so the actual return on your contribution is about 67%-89.5%. (You can find out why here) It’s still an unbeatable risk-free guaranteed return.

Member Tax Credit

KiwiSaver Member Tax Credit is to help you save on your KiwiSaver. The government will make an annual contribution to your KiwiSaver fund (a.k.a Free money). The amount is $0.5 on every dollar up to $521.43. You will have to be 18 or above to receive the tax credit. This is a way of government help you save for your retirement and encourage you to join the plan. It cap at $521.43 so it will benefit for the most full-time employee but not favour mid to high-income earner.

Return on Employee

If you are over 18, fully employed, annual income at $55,000 before and contribute at 3%. Your minimum return on your contribution will be like this.

Your annual contribution (3%): $1650

Employer contribution after tax: $1361.25

KiwiSaver Member Tax Credit: $521.43

The return on your investment: (1650 + 1361.25 + 521.43 – 1650) / 1650 = 114%

Return on Self-Employed

If you are self-employed, you won’t get the employer match, but you are still entitled to member tax credit as long as you make a minimum manual contribution for $1042.86

Your manual contribution: $1042.86

KiwiSaver Member Tax Credit: $521.43

The return on your investment: (1042.86+ 521.43 – 1042.86)/ 1042.86 = 50%

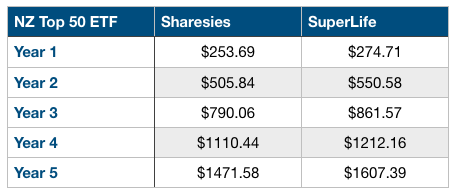

Those are only your base return; you are likely to make investment return on your KiwiSaver Fund as well. Here is a couples data on a KiwiSaver fund with different income level. The KiwiSaver fund cost and return data are based on SuperLife 80.

No. 3 – Reduce your Mortgage

Mortgage payment can easily be the biggest expenses on most homeowners’ budget. Average first home buyer will spend $1500/month on the mortgage, and it will cost more if you have a mortgage in a major city. Imagine what you can do with that money if you don’t have a mortgage payment.

Return on Reducing Mortgage

Paying off have the same effect on paying off consumer debt. It will give you a tax-free and guaranteed return. The return is not as high as those consumer debts because the interest rate on the mortgage is lower at 4% – 6%. The equivalent pre-tax return is around 8.3%.

Reduce your Mortgage or Invest elsewhere

Some people may think 7-8% is not a very good return, and you can achieve that with other investment options without taking a lot of risks, like the share market. However, I still think paying off the mortgage on your own home is a better option because you are paying off an asset that will provide you with a place to live, offset the cost of renting in the future and the house will increase in value (in the long term for most cases).

If you can’t decide to reduce mortgage or invest elsewhere, ask yourself a simple question:

If you fully owned your house today, will you borrow $500k on your mortgage-free house to invest in share market? Or you will use your income to invest in the stock market every month?

If you say you won’t borrow on your mortgage-free home (like me), then you should focus on reducing that mortgage now. I basically asked the same questions but put it in a different perspective. If you have the money to reduce the mortgage, but you put it into the share market, you are basically borrowing on your house to share market.

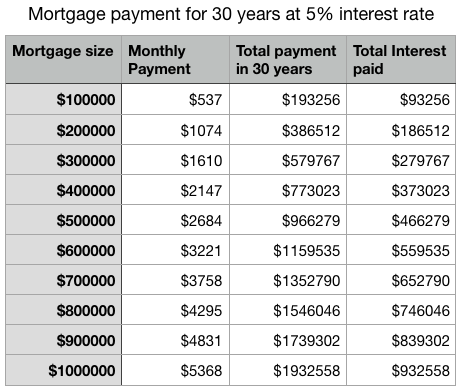

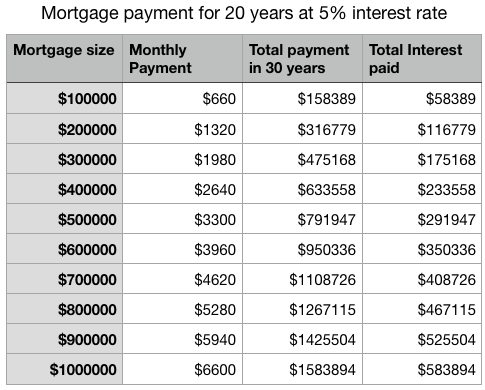

Saving Big on interest expense

Since the mortgage size is usually over $200K (over $500k in Auckland) and the payment terms are 20-30 years. You end up paying A LOT on interest expenses. Check out the chart below.

For a 30 years term mortgage at 5% interest rate, you will end up paying 93% extra for interest payment. So what will happen if we increase our payment and shorten the mortgage by ten years?

When we shorten the mortgage term by ten years (-33%), our monthly payment increased by 23%, total interest paid decreased by 37.3%! Only 36.9% of your payment went to interest.

Reducing mortgage may not give you a high percentage return, but due to the size of the mortgage, the saving you are likely to make is in the hundreds of thousands. I will have a series of blog posts in the coming month to show you how to be smart on your mortgage with different setup and tips.

Conclusion

- The top 3 investment options in New Zealand are paying off consumer debt, join KiwiSaver and reducing your mortgage.

- Paying off consumer debt is investing. The returns are in the range of 15% – 35%. You will be in a better financial position once you pay off your debt.

- A KiwiSaver member can enjoy instant return from minimum 50% – 110% due to member tax credit and employer match. However, that money is locked-in until you purchase your first home or turn 65.

- Paying off return about 7% – 8% on your dollar, not as high compared to other. However, due to the size of the mortgage and interest paid, you are likely to be saving hundreds of thousand of the dollar

Email thesmartandlazy@gmail.com or follow me on Twitter @thesmartandlazy if you have any questions.